The Stock Exchange of Thailand (SET) is the primary equity marketplace in Thailand and one of the more advanced emerging markets in ASEAN. It serves as the core platform for Thai companies to raise capital and for domestic and international investors to trade equities, ETFs, derivatives, DRs, and bonds. This guide explains the structure, microstructure, indices, listing regime, ESG framework, and investor access in a single, authoritative resource, tailored for both institutional and individual investors, including foreign participants.

What Is the Stock Exchange of Thailand (SET)?

The Stock Exchange of Thailand (SET) is Thailand’s principal securities exchange, operating under the Securities and Exchange Act B.E. 2535 (1992). It is organized as a non‑profit public‑interest organization, with the primary mandate to promote savings, long‑term capital formation, and efficient price discovery for Thai‑listed securities.

Role in the Thai economy

The SET functions as the core primary and secondary market for corporate equities, enabling companies to raise long‑term capital via IPOs and additional offerings, while providing liquidity for existing shareholders. By facilitating investment in listed firms, the SET supports private‑sector growth, infrastructure development, and industrial diversification in Thailand.

Capital market function

As a key component of the Thai capital market, the SET:

- Provides a regulated, transparent trading venue for listed securities.

- Ensures standardized information disclosure by listed companies.

- Supports market surveillance to detect manipulation, insider trading, and other market‑abuse activities.

- Connects savers and investors with corporate capital‑users through equity and derivative instruments.

Exchange vs regulator vs broker

- Exchange (SET): Operates the trading platform, sets listing and trading rules, and surveils market activity. SET itself is not a regulator or a broker.

- Regulator (SEC, BOT): The Securities and Exchange Commission (SEC) oversees the securities market, while the Bank of Thailand (BOT) supervises banks and money markets. Both enforce compliance and investor‑protection rules.

- Brokers (members): Licensed securities firms that execute client orders on the SET system, provide custody, and handle settlement and reporting.

SET history & evolution

The Securities Exchange of Thailand opened on 30 April 1975 following the enactment of the Securities and Exchange Act. On 1 January 1991, it changed its name to the Stock Exchange of Thailand (SET). Over time, it has expanded to include:

- The mai (Market for Alternative Investment) for SMEs and growth‑oriented companies.

- The LiVe Exchange for SMEs and startups.

- The Thailand Futures Exchange (TFEX) for derivatives.

Emerging market status

The SET is widely classified as an advanced emerging market, with relatively high liquidity, diversified investor base, and well‑developed infrastructure. It ranks among the largest ASEAN exchanges by market capitalization, behind only Indonesia and Singapore.

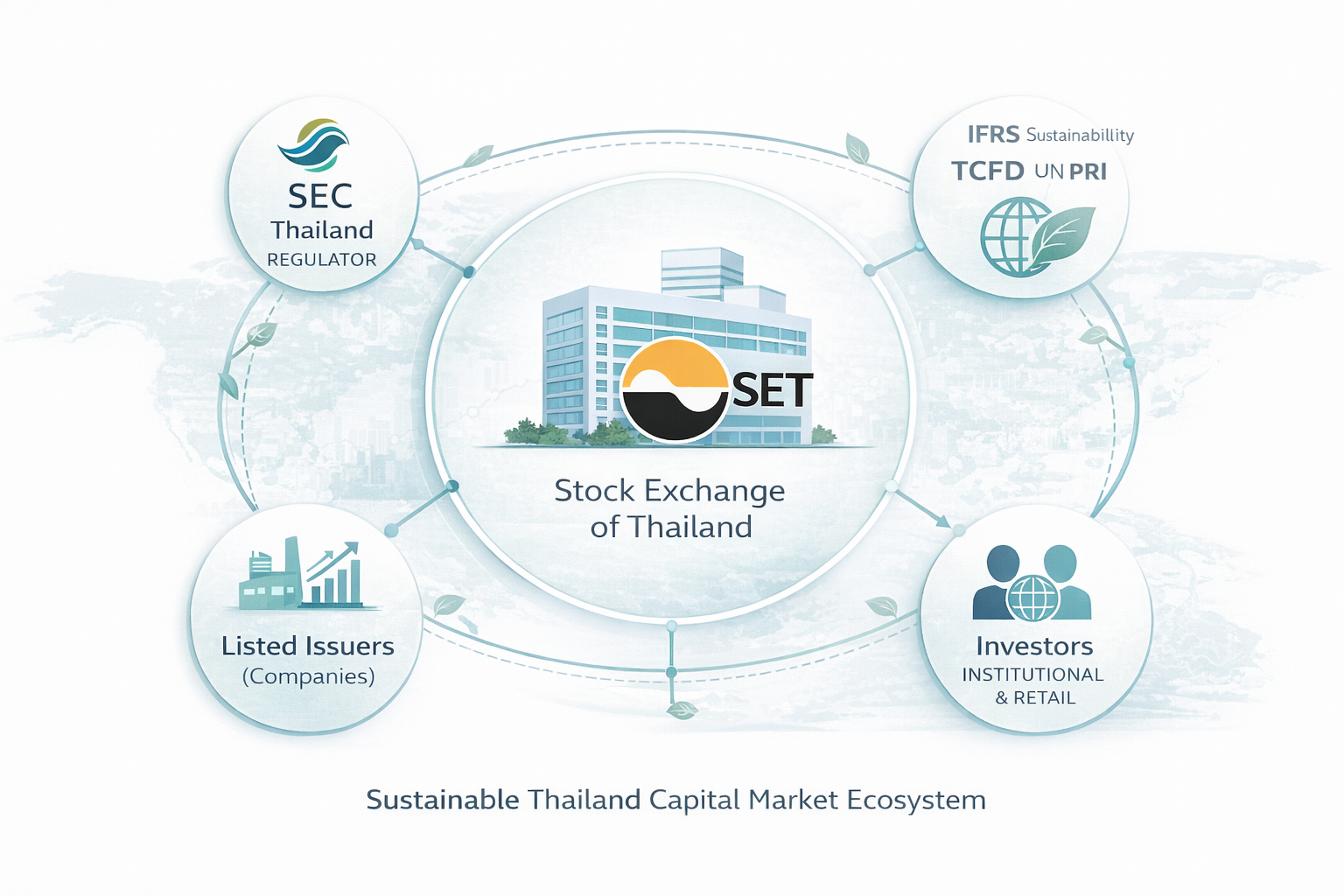

Structure of the Thai Capital Market

Thailand’s capital market is a multi‑layered ecosystem centered on the SET Group, which includes the SET, mai, TFEX, TSD, and TCH, alongside the SEC, BOT, clearing banks, custodians, and brokers.

Core components

- SET (Stock Exchange of Thailand): Main equity exchange for large‑ and mid‑cap companies.

- mai (Market for Alternative Investment): Secondary board for SMEs and emerging‑growth firms, with more flexible listing criteria.

- LiVe Exchange: Recently launched platform for SMEs and startups, designed to facilitate smaller capital‑raising rounds.

- TFEX (Thailand Futures Exchange): Derivatives exchange for futures and options on equities, indices, FX, and commodities.

Clearing, depository, and settlement

- TSD (Thailand Securities Depository): Central securities depository providing scripless settlement, securities registration, and depository services for equities and bonds.

- TCH (Thailand Clearing House): Central counterparty (CCP) for equities, bonds, and derivatives traded on SET, mai, and TFEX, guaranteeing settlement and reducing counterparty risk.

Regulators

- Securities and Exchange Commission (SEC): Regulates the securities market, approves public offerings, and supervises exchanges and intermediaries.

- Bank of Thailand (BOT): Oversees monetary policy, banks, and FX markets; coordinates with the SEC on systemic‑risk issues.

Intermediaries

- Securities companies / brokers: Members authorized to trade on the SET, execute client orders, and provide custody and margin services.

- Custodians and clearing banks: Provide safekeeping of securities and cash, and support the clearing and settlement chain.

Markets Operated by SET

The SET operates several distinct markets, each serving different segments of issuers and investors.

Equities

The main SET board lists large, established companies meeting strict profitability, free‑float, and governance criteria. Equities are traded in board lots (typically 100 shares), with some high‑price stocks allowed smaller minimum lots.

ETFs

The SET offers exchange‑traded funds (ETFs) listed and traded like ordinary shares, providing diversified exposure to indices, sectors, or thematic baskets (e.g., energy, banks, ESG). ETFs generally trade with a tick size of 0.01 THB and are subject to specific listing and disclosure rules.

Derivatives

Derivatives are handled by TFEX, which provides futures and options contracts on:

- Equity indices (e.g., SET50 index futures).

- Single‑stock futures on major blue‑chips.

- FX and commodity futures, including agricultural products and energy.

DR / DRx

The SET supports depositary receipts (DRs) and newer DRx (digital depositary receipts) programs, allowing foreign investors to invest in Thai securities and vice versa in a regulated, cross‑border framework. DRs are denominated in foreign currencies and settled through international clearing chains.

Bonds

Debt securities are primarily the domain of the Thai bond market, overseen by the SEC and the Thai Bond Market Association (ThaiBMA). However, the SET provides listing and disclosure infrastructure for corporate bonds, and the clearing and settlement infrastructure via TCH is interoperable with bond trades.

SET Indices Explained

The SET maintains a multi‑layer index series that serves as benchmarks, underlying assets for derivatives, and tools for ESG and thematic investing.

SET Index

The SET Index is a market‑capitalization‑weighted index comprising all listed companies on the main SET board. It is recalculated continuously and is the primary benchmark for the Thai equity market.

SET50 and SET100

- SET50: Market‑cap‑weighted index of the top 50 companies by market value and liquidity, used as the underlying for index futures and options.

- SET100: Includes the top 100 companies, incorporating the SET50 universe.

Free‑float adjusted indices

- SET50FF and SET100FF are free‑float market‑cap indices that adjust for non‑investable shares (e.g., government holdings, locked‑in blocks). These indices better reflect investable liquidity and are used by institutional and index‑based strategies.

Sector and industry indices

The SET publishes sector and industry indices (e.g., banking, energy, property), which:

- Reflect the performance of specific economic sectors.

- Serve as reference benchmarks for sector‑specific funds and ESG‑themed products.

How Trading Works on the SET

Thailand’s equity market is a fully electronic, order‑driven system with standardized sessions, auction mechanisms, tick rules, and T+2 settlement.

Trading hours

For the day trading session, the standardized framework is:

- Pre‑open I: 09:30–T1 (auction phase).

- Trading Session I: T1–12:30.

- Intermission: 12:30–13:30.

- Pre‑open II: 13:30–T2.

- Trading Session II: T2–16:30.

- Pre‑close: 16:30–T3.

- Off‑hour: T3–17:00 (orders remain in system but not executable until next day).

Some derivatives and late‑trading equities operate on night trading hours (e.g., 18:45–02:45 local time), with their own pre‑open and pre‑close auctions.

Auction phases

- Opening auction: From pre‑open until T1, the system collects orders and determines the opening price that maximizes traded volume.

- Closing auction: At 16:30–T3, the closing price is computed via an auction mechanism using eligible orders, with T3 randomly set between 16:35 and 16:40 to mitigate last‑second manipulation.

Order types

The SET supports several order types, including:

- Limit orders: Specify maximum buy or minimum sell price.

- Market orders: Execute at the best available price.

- Fill‑or‑kill / Immediate‑or‑cancel: Partial‑fill restrictions for liquidity‑sensitive strategies.

- Day orders and Good‑Till‑Date variants for time‑in‑force.

Tick sizes

Tick sizes are tiered by price band, for example:

- 10–<25 THB: 0.10

- 25–<100 THB: 0.25

- 100–<200 THB: 0.50

- 200–<400 THB: 1.00

- 400+ THB: 2.00

These increments apply to ordinary stocks and listed bonds; ETFs and unit trusts typically use a 0.01 THB tick.

Price limits and settlement

- Daily price bands are generally set at ±30% of the previous closing price, with some exceptions for specific instruments.

- Settlement occurs on T+2 for equities and bonds, with securities and cash transferring via TSD and TCH using DvP (delivery‑versus‑payment) mechanisms.

SET Trading Services & Infrastructure

The SET has migrated to a new trading system and data dissemination platform to support higher speeds, straight‑through processing, and advanced connectivity options. This NLP phrase can be embedded naturally as:

“SET’s AI‑ and automation‑enabled trading services and infrastructure provide firms with low‑latency, scalable, and resilient access to the Thai market.”

Electronic trading system

- Order‑driven limit‑order book with continuous matching and auctions at open and close.

- New trading system launched in 2023, integrating updated market surveillance, data dissemination, and connectivity protocols with members’ systems.

Connectivity

- Direct market access (DMA) and API‑based interfaces are available to brokers and institutional participants.

- Low‑latency gateways support algorithmic and programmatic trading, subject to approval and compliance rules.

Brokerage routing

Orders are routed from the client → broker → SET trading system, where the matching engine computes trades based on price and time priority. Brokers aggregate orders from multiple clients and may apply risk controls and pre‑trade compliance checks.

Post‑trade services

- Clearing and settlement: TCH acts as the central counterparty, netting trades and guaranteeing settlement.

- Depository services: TSD maintains the electronic registry of securities holders and provides collateral‑management and pledging services.

Listing & Thai Listed Companies

The SET’s listing regime is designed to attract high‑quality issuers while maintaining investor protection and market integrity.

Listing requirements (main board)

Key requirements for main‑board listing include:

- Sustained profitability (typically ≥75 million THB net profit in the latest year, with cumulative thresholds over 2–3 years).

- Minimum paid‑up capital (e.g., ≥800 million THB for large firms).

- Free float requirements (e.g., ≥20% of paid‑up capital, with a minimum free‑float value).

- Disclosure and governance standards aligned with SEC and SET rules.

Segment overview: SET, mai, LiVe

- SET: Large, established companies; highest listing standards and strongest governance.

- mai: SMEs and growth‑oriented firms; lower profitability thresholds and more flexible rules while still mandating quarterly disclosures.

- LiVe Exchange: Tailored for SMEs and startups; focuses on simpler reporting and smaller fundraising rounds, with no mandatory free‑float requirement.

Sectors and market‑cap distribution

Thai listed companies span:

- Banking and finance (large universal banks and finance companies).

- Energy and utilities (PTT, EGCO, GULF, etc.).

- Property and real estate (developers and REITs).

- Consumer, retail, and food & beverages.

- Healthcare and infrastructure (airports, toll roads, utilities).

Market cap is concentrated in the top 50–100 companies, but the mai and LiVe segments add depth in SMEs and niche sectors.

Governance standards

The SET mandates minimum corporate‑governance practices, including:

- Board independence and audit committees.

- Financial‑reporting transparency and timely disclosures.

- Enhanced ESG and sustainability reporting over time.

Sustainable Development & ESG in SET

The SET has positioned itself as a leader in sustainable finance and ESG disclosure among ASEAN exchanges.

SET ESG ratings

The SET ESG Ratings evaluate listed companies on environmental, social, and governance criteria, using a standardized framework. Research shows that firms with higher SET ESG ratings experience higher firm value, lower cost of capital, and stronger investor confidence.

Sustainability initiatives

- Sustainability‑linked financing: The SET promotes green bonds and sustainability‑linked instruments and works with issuers to align with international standards.

- Sustainable finance ecosystem: The exchange collaborates with the SEC, BOT, and ThaiBMA to develop market‑wide frameworks for green and social finance.

Disclosure standards

- ESG reporting is mandatory for listed companies under the SET’s listing rules, with guidance on scope and metrics.

- The SET participates in global initiatives such as the Sustainable Stock Exchanges (SSE) Initiative, reinforcing its ESG‑integration agenda.

Who Can Invest in the SET?

The SET is accessible to both domestic and foreign investors, with differentiated rules and limits.

Thai investors

- Individuals and Thai institutions can open accounts with local brokers and trade directly on the SET.

- No citizenship or residency restrictions, but investors must comply with KYC and AML rules.

Institutions

- Pension funds, insurance companies, asset managers, and hedge funds