Thai listed companies on the Stock Exchange of Thailand (SET) offer broad exposure to the country’s banks, energy majors, telecom operators, consumer leaders, and tourism‑linked assets. This guide maps the Thai equity universe by market, index, sector, and investment style, turning raw stock lists into an investor‑ready market overview.

Overview of Thai Listed Companies

The Thai equity market is organized primarily into two boards: SET (main board) and mai (Market for Alternative Investment). Together they host over 800 listed companies, spanning virtually all parts of the Thai economy.

- As of early 2024, there were around 840 listed companies (about 627 on SET and 213 on mai).

- As of January 2024, official statistics showed 628 Thai companies on SET and 212 on mai, illustrating ongoing IPO activity and board migrations.

SET vs mai

- SET (main board):

- mai (Market for Alternative Investment):

- Focused on small and medium‑sized enterprises (SMEs) and growth companies.

- Lower thresholds for size and track record but still subject to disclosure and governance rules.

Economy representation

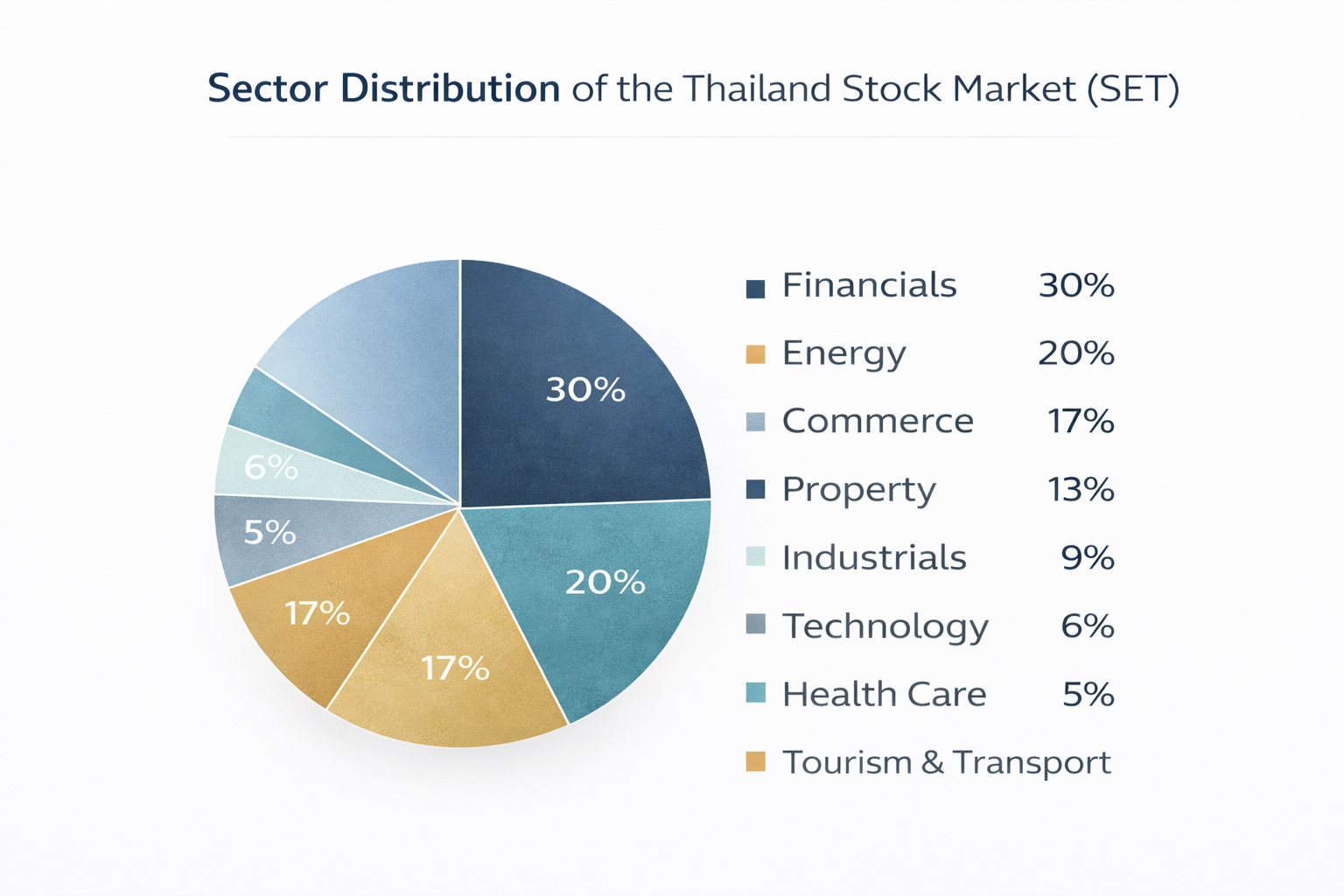

The listed universe broadly reflects Thailand’s economic structure:

- Financials (banks + finance) and energy/resources are heavyweights.

- Commerce (retail), food, and consumer names mirror domestic consumption.

- Tourism, transport, and leisure names provide direct exposure to Thailand’s globally important visitor economy.

Largest Thai Companies on the SET

The largest Thai companies by market capitalization are concentrated in energy, banking, telecoms, retail, and transport. Rankings move with market prices, but the same core names dominate major indices and foreign portfolios.

Representative large‑cap leaders (illustrative, not exhaustive)

Below is a sample table of major large‑cap Thai companies commonly appearing at the top of market‑cap rankings. Exact ranks and market caps change daily; investors should always confirm current data via real‑time sources.

SET50 Companies List

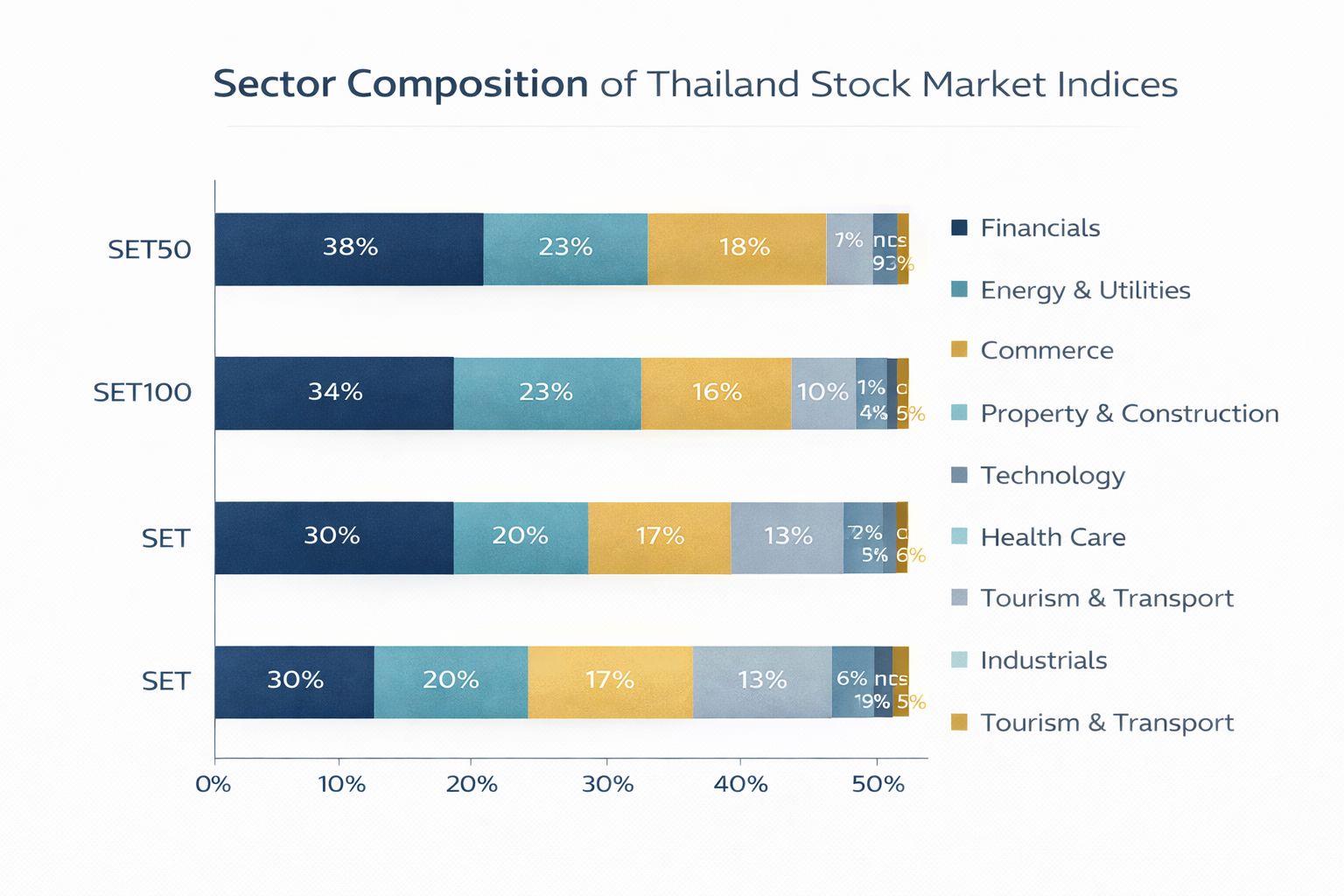

The SET50 Index is the flagship large‑cap benchmark of the Thai market. It contains the 50 largest and most liquid stocks listed on the SET, adjusted for free float.

Role of the SET50 Index

- Serves as the primary benchmark for Thai large‑caps.

- Underlies SET50 futures and options on TFEX, as well as multiple ETFs and structured products.

- Often used as the core building block for Thai equity allocations in both domestic and global portfolios.

Example SET50 constituents and sectors (H1 2025 methodology)

The official SET50 list is updated semi‑annually; an abbreviated snapshot (H1 2025 reference) includes:

- Energy & Utilities: PTT, PTTEP, BGRIM, GULF, GPSC, EGCO.

- Banking: BBL, KBANK, KTB, SCB, BAY, TTB.

- Commerce (Retail): CPALL, BJC, HMPRO, MAKRO.

- Information & Communication Technology: ADVANC, TRUE, DTAC (legacy), ICT names.

- Transportation & Logistics: AOT, BTS, BEM, shipping and logistics names.

- Property Development & REITs: AWC, CPN, leading developers and property funds.

- Health Care Services: BH (Bumrungrad Hospital), BDMS (Bangkok Dusit Medical Services).

Investors should always download the current SET50 list from SET or licensed data vendors before making index‑tracking decisions.

SET100 Companies Overview

The SET100 Index extends the universe to the 100 largest and most liquid companies on the SET, providing broader market coverage.

- It includes all SET50 members plus 50 additional mid‑caps, making it useful for balanced exposure to large and mid‑sized Thai companies.

- Sector representation broadens to include more industrials, mid‑cap property and construction names, secondary banks and finance companies, and specialized services.

Typical SET100 members beyond the core SET50 include:

- Mid‑cap airlines and transport operators (e.g., Asia Aviation – AAV).

- Additional health‑care providers, industrial manufacturers, and niche financials.

Thai Stocks by Sector

The SET uses a detailed industry and sector classification that groups companies into industry groups (e.g., Financials, Resources, Services) and business sectors (e.g., Banking, Energy & Utilities, Commerce).

Energy & Petrochemicals

Sector classification: Primarily under Resources – Energy & Utilities, and Industrials – Petrochemicals & Chemicals.

Representative major companies:

- PTT (PTT) – Integrated state‑linked energy group; key benchmark for Thai energy exposure.

- PTT Exploration & Production (PTTEP) – Upstream oil & gas exploration and production arm of PTT.

- PTT Global Chemical (PTTGC) – Petrochemicals and chemical manufacturing within the PTT group.

- Indorama Ventures (IVL) – Global PET and polyester chemicals producer with Thai base.

- Bangchak Corporation (BCP), IRPC, GULF, BGRIM – Refining, integrated energy, and power producers.

Market relevance:

- The energy and petrochemical complex is a core driver of Thai export earnings and index earnings, making it central to macro‑thematic and factor investing in Thailand.

Banking & Finance

Sector classification: Financials – Banking, Finance & Securities, Insurance.

Major banks:

- Bangkok Bank (BBL) – Large corporate and trade‑focused bank.

- Kasikornbank (KBANK) – SME and retail‑oriented bank with digital capabilities.

- Siam Commercial Bank (SCB) – Universal bank with broad retail and corporate business.

- Krungthai Bank (KTB) – State‑linked bank with wide retail network.

- Bank of Ayudhya (BAY) – Part of MUFG group, with retail and corporate franchise.

Other financials:

- TISCO Financial Group (TISCO) – Niche bank/finance firm, appears in SET50/SET100 lists.

- TMBThanachart Bank (TTB) – Consolidated bank with retail lending focus.

Market role:

- The banking sector is a key component of the SET’s financials weighting and provides exposure to Thailand’s credit cycle, household leverage, and SME financing.

Telecommunications

Sector classification: Technology – Information & Communication Technology (ICT).

Major telecom operators:

- Advanced Info Service (ADVANC) – Market‑leading mobile operator; core ICT blue chip.

- TRUE Corporation (TRUE) – Integrated telecom and broadband provider.

- (Legacy) Total Access Communication (DTAC) – Previously one of the three main mobile operators; corporate developments may change listing status over time.

Market role:

- Telecom stocks provide defensive cash flows and dividend yield, and are closely linked to digital‑economy themes.

Retail & Consumer

Sector classification: Services – Commerce, and Agro & Food Industry – Food & Beverage.

Key retail and consumer names:

- CP All (CPALL) – Operates 7‑Eleven convenience stores; core domestic demand proxy.

- Berli Jucker (BJC) – Consumer and packaging conglomerate with retail footprint.

- Home Product Center (HMPRO) – Home improvement retail chain.

- BigC / MAKRO (if listed under relevant structure) – Wholesale/retail players.

- Thai Beverage (THBEV), Thai Union Group (TU), Charoen Pokphand Foods (CPF) – Food and beverage groups with strong domestic and export exposure.

Market role:

- These stocks are high‑beta to domestic consumption, minimum wage policy, and tourism flows, often used by investors to express views on Thai household spending.

Healthcare

Sector classification: Services – Health Care Services, and Consumer Products – Personal Products & Pharmaceuticals.

Major listed hospital groups:

- Bumrungrad Hospital (BH) – Internationally renowned private hospital; medical tourism proxy.

- Bangkok Dusit Medical Services (BDMS) – Large hospital network across Thailand.

- Bangkok Chain Hospital (BCH) – Mid‑tier hospital group, often heavily traded by foreign investors.

Market role:

- Healthcare stocks are viewed as defensive growth with exposure to ageing demographics and medical tourism, often featuring high foreign interest.

Industrials

Sector classification: Industrials – Automotive, Industrial Materials & Machinery, Packaging, Paper & Printing, Petrochemicals & Chemicals, Steel & Metal Products.

Representative companies:

- Siam Cement (SCC) – Building materials and industrial conglomerate.

- Indorama Ventures (IVL) – Global chemical and packaging producer.

- Thai industrial manufacturers in automotive components, machinery, and packaging that support export and domestic infrastructure cycles.

Market role:

- Industrial names provide exposure to capital‑expenditure cycles, construction demand, and export competitiveness, and often behave cyclically with global manufacturing.

Tourism & Transport

Sector classification: Services – Tourism & Leisure, Transportation & Logistics.

Key tourism‑linked names:

- Airports of Thailand (AOT) – Manages major airports including Suvarnabhumi and Don Mueang; a direct proxy for tourist arrivals.

- Asia Aviation (AAV) – Airline holding company, linked to low‑cost carriers.

- Hotel and leisure groups and cruise/transport operators within Tourism & Leisure.

Market role:

- This cluster is highly sensitive to global travel conditions, airline economics, and FX, and is a core way to trade Thailand’s tourism story.

Blue‑Chip Thai Stocks

“Blue‑chip” Thai stocks are typically:

- SET50 constituents.

- Large, liquid, widely held by both domestic and foreign investors.

- Core holdings in Thai mutual funds, index funds, and foreign emerging‑market portfolios.

Representative blue chips (indicative):

- PTT, PTTEP, PTTGC – Energy and petrochemicals group.

- BBL, KBANK, SCB, KTB – Major banks.

- ADVANC – Telecom leader.

- CPALL, BJC, HMPRO – Key retail names.

- AOT – Flagship transport/tourism stock.

- SCC, IVL – Industrials and chemicals.

- BDMS, BH – Core healthcare names.

These names usually feature better liquidity, robust disclosure, and established governance frameworks compared to smaller companies.

Foreign Investor Popular Thai Stocks

Foreign investors play a large and sometimes dominant role in Thai trading turnover. In certain months, they account for over 50% of trading value on the SET.

Patterns from foreign‑flow and NVDR (Non‑Voting Depository Receipt) data show consistent interest in:

- AOT – Tourism gateway; popular among foreign institutions and funds.

- PTT, PTTEP, PTTGC – Energy complex; used in regional EM energy strategies.

- CPALL, HMPRO – Retail and consumption proxies.

- True, ADVANC – Telecom exposure.

- BCH, BDMS, BH – Healthcare stocks often among top foreign net buys in NVDR data.

- Major banks such as BBL, KBANK, SCB, KTB, TTB – Core financials exposure for EM portfolios.

Foreign investors also use NVDRs to bypass certain voting‑rights/foreign room constraints while maintaining economic exposure.

How Thai Listed Companies Reflect the Economy

Sector weights in the SET help investors understand where Thailand’s corporate earnings actually come from.

- Energy & Resources: Large share of index earnings, reflecting Thailand’s role in regional energy production and refining.

- Banking & Financials: Heavy index weight, mirroring the central role of banks in credit intermediation.

- Tourism & Transport: Significant presence via AOT, airlines, hotels, and logistics companies, reflecting tourism as a key GDP component.

- Domestic Consumption: Commerce (retail), food, and consumer products show the importance of household spending.

For macro‑investors, the SET provides levered exposure to Thailand’s growth drivers: tourism, consumer spending, regional trade, and energy.

Growth vs Dividend Thai Stocks

Thai equities can be broadly mapped into growth, dividend, defensive, and cyclical clusters. Exact categorization depends on valuation, earnings trajectories, and payout policies, which evolve over time.

Growth‑oriented names

Typically:

- Higher reinvestment rates, lower payout ratios.

- Exposure to expanding sectors such as technology, certain consumer segments, and specific industrials.

Indicative examples:

- Selected technology / ICT names beyond core incumbents.

- Certain mid‑cap industrials, logistics, and e‑commerce‑related commerce names.

Dividend and income stocks

Typically:

- Mature businesses with stable cash flows and above‑average dividend yields.

- Often in telecoms, utilities, REITs, and some financials.

Indicative examples:

- ADVANC – Well‑known for consistent dividends.

- Selected power producers and utilities (e.g., BGRIM, EGCO, GPSC) and REITs/property funds.

- Some banks with stable payout policies (BBL, KTB, etc.).

Defensive vs cyclical

- Defensive: Health care (BDMS, BH, BCH), telecom (ADVANC), and certain consumer staples (food & beverage leaders) often display lower earnings volatility.

- Cyclical: Energy and petrochemicals (PTT, PTTEP, PTTGC, IVL), export‑oriented industrials, and tourism stocks (AOT, airlines, hotels) are more sensitive to global cycles, commodity prices, and tourism flows.

Investors typically combine these segments to balance income, growth, and volatility in Thai market exposure.

How to Use Thai Stock Lists for Investing

A curated Thai stock list is most useful when integrated into a structured investment process, not just as a database.

Sector diversification

- Start by mapping holdings across SET sector classifications: Financials, Resources, Services, Technology, Industrials, Property & Construction, Consumer, Agro & Food Industry.

- Avoid excessive concentration in one macro theme (e.g., tourism or energy) by cross‑checking sector weights against your risk tolerance.

Index tracking and core‑satellite

- Use SET50 and SET100 lists as core portfolios for large‑cap and large‑mid exposure.

- Add satellite positions in sector or thematic leaders (e.g., tourism, healthcare, export‑oriented industrials) based on specific macro or structural views.

Portfolio construction considerations

When constructing a Thai equity allocation:

- Align sector and style tilts with macro views (growth, inflation, tourism cycles, energy prices).

- Monitor foreign‑room constraints and consider NVDRs or ETFs as alternatives when direct foreign share classes are tight.

- Use local and regional ETFs or fund vehicles for efficient broad exposure if individual stock selection is not a priority.

Risks of Investing in Individual Thai Companies

While Thai blue chips and sector leaders can be attractive, individual‑stock investing on the SET carries several key risks.

Governance and disclosure

- Governance quality varies across companies; blue chips and ESG‑rated firms generally maintain higher disclosure standards than smaller issuers.

- Investors should review Form 56‑1 One Reports, annual reports, and ESG disclosures for clarity on strategy, risk, and control structures.

Liquidity risk

- Liquidity is strong in SET50/SET100 names but can fall sharply in smaller SET and mai stocks.

- In thinly traded names, bid‑ask spreads widen, and large orders can materially move prices, especially during stress periods.

Foreign quota and structural constraints

- Foreign investors are subject to foreign‑ownership limits, with “foreign room” sometimes fully utilized in popular stocks.

- NVDR structures mitigate some constraints but do not convey voting rights, which may matter to some investors.

Currency and macro risk

- Thai stocks are denominated in THB, so foreign investors face FX risk versus their home currency.

- Macro shocks (tourism downturn, political uncertainty, commodity swings) can disproportionately impact certain sectors like tourism, energy, and banks.

FAQ About Thai Stocks

How many companies are listed on the SET?

- As of early 2024, there were about 840 listed companies across SET and mai (roughly 627 on SET and 213 on mai).

- As of January 2024, official data cited 628 SET and 212 mai listed Thai companies.

What are the biggest Thai firms on the stock market?

- The largest Thai listed firms by market cap generally include PTT, PTTEP, AOT, ADVANC, SCC, CPALL, major banks (BBL, KBANK, SCB, KTB), IVL, and leading utilities and retailers.

What is the SET50 list?

- The SET50 Index contains 50 large‑cap, high‑liquidity stocks from the SET main board, used as a benchmark and derivatives underlying.

- The list is updated semi‑annually; investors can download the current constituents from the SET website and official documents.

What sectors do Thai stocks cover?

- Thai listed companies span Agro & Food Industry, Consumer Products, Financials, Industrials, Property & Construction, Resources (Energy & Utilities, Mining), Services (Commerce, Health Care, Tourism & Leisure, Transportation & Logistics, Media, Professional Services), and Technology (Electronic Components, ICT).

How can foreigners invest in Thai stocks?

- Foreigners can invest via Thai brokers, global brokers offering Thai access, Thai or regional ETFs and mutual funds, and depository receipts/NVDRs.

- They must observe foreign‑ownership limits, tax rules, and may use NVDRs where foreign room is restricted.

This guide is an interpretive overview; for live data, detailed lists, and trading decisions, investors should consult the SET, licensed data providers, and regulated financial advisers.