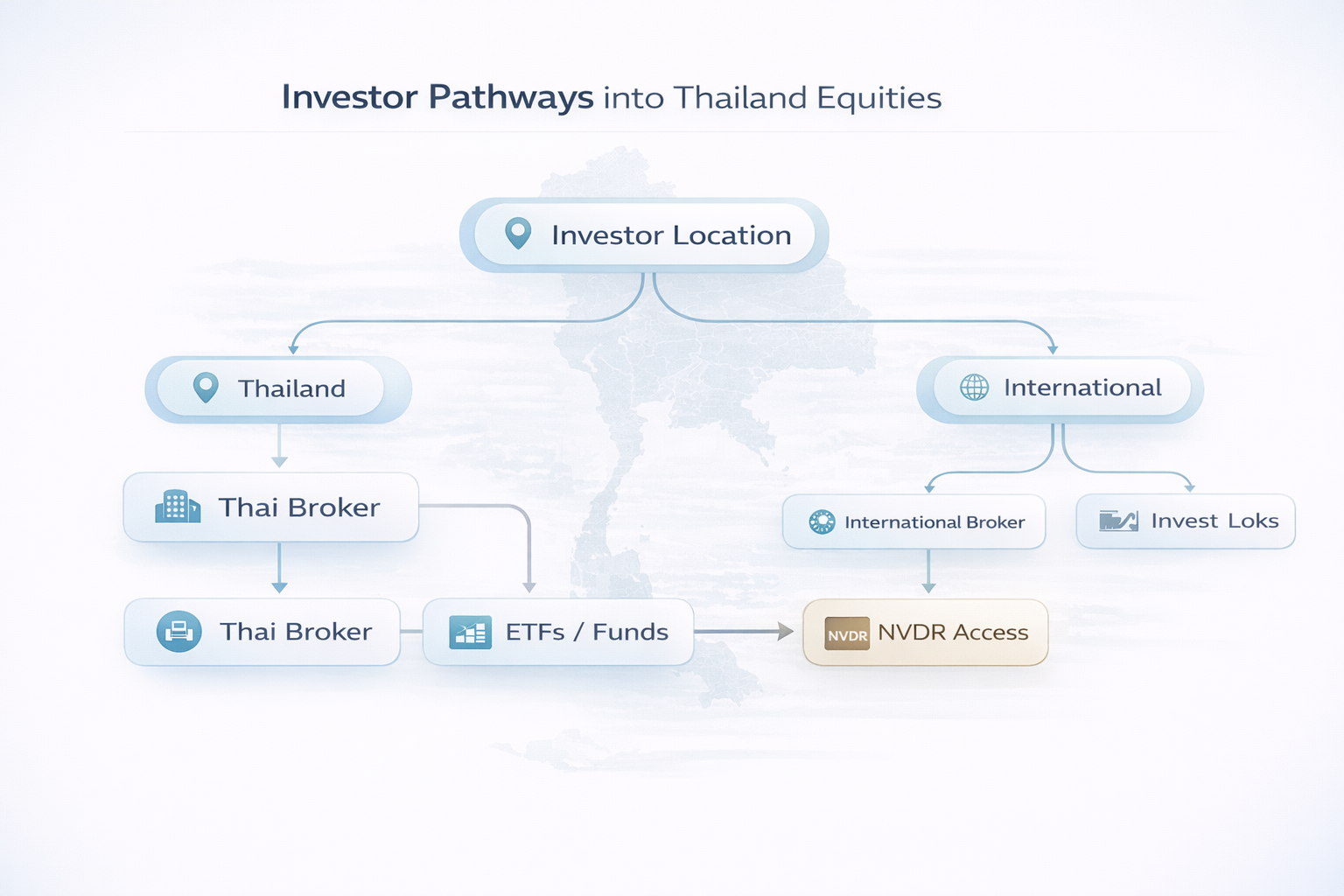

The Thailand stock market is open to Thai residents, expats, and global investors through a mix of local brokerage accounts, international platforms, ETFs, funds, and NVDR structures. This guide explains who can invest, all access routes, how accounts and custody work, and the tax and regulatory details that matter in practice.

Can You Invest in the Thailand Stock Market?

Eligibility by investor type

You can invest in Thai listed securities if you fall into any of these categories:

- Thai residents (citizens and tax residents)

- Can open standard securities accounts with Thai brokers and banks.

- Eligible for local share classes and NVDRs, subject to KYC and suitability checks.

- Expats living in Thailand (foreign individuals with local address/visa)

- Can generally open accounts at Thai brokers if they provide valid passport, visa, work permit or proof of residence, and local bank account details.

- Non‑resident foreign individuals

- May access Thai equities via:

- International brokers that offer access to SET/TFEX.

- Thai NVDRs and foreign share classes through cross‑border custody.

- Offshore or regional ETFs and funds holding Thai stocks.

- May access Thai equities via:

- Institutional investors (funds, family offices, corporates)

- Can invest directly through global custodians and local sub‑custodians.

- Must comply with investment regulation, foreign ownership rules, and reporting.

Foreign ownership rules in brief

- Many Thai companies are subject to a foreign ownership limit (often 49% in regulated sectors).

- When the foreign room is full, foreigners can still invest via NVDRs (Non‑Voting Depository Receipts) without breaching foreign limits.

Overview of Investment Options in Thailand

Investors have several distinct access routes to Thai equity exposure.

Direct Thai stocks

- Ordinary shares listed on SET and mai (local and foreign share classes).

- Accessible via:

- Thai brokers (for residents and qualified foreign clients).

- International brokers with Thai market access.

NVDRs (Non‑Voting Depository Receipts)

- NVDRs are exchange‑listed instruments issued by Thai NVDR Co., Ltd., that mirror the price and economic benefits of underlying Thai shares without voting rights.

- They trade on the same board, at the same price as local shares, and allow foreigners to invest even when foreign room is full.

ETFs (Thailand‑listed and offshore)

- SET‑listed ETFs:

- Track SET50, SET100, sector indices, or bonds.

- Trade in THB on the SET.

- Offshore ETFs:

- US, European, or regional ETFs that allocate part of their portfolio to Thai stocks (e.g., broad ASEAN or EM ETFs).

DR / DRx and structured products

- Depository Receipts (DR/DRx):

- Thai‑listed instruments giving exposure to foreign stocks or indices.

- Structured notes and certificates:

Derivatives (TFEX)

- SET50 index futures and options, single‑stock futures, and other derivatives trade on TFEX, part of SET Group.

- Used for:

- Hedging Thai equity portfolios.

- Tactical exposure with leverage.

How Thai Residents Invest in Thai Stocks

For Thai residents, the process is comparable to other developed markets.

Local brokerage account

Thai individuals typically:

- Choose a Thai securities company (standalone broker or bank‑owned).

- Open a cash or margin account, often linked directly to a Thai bank account.

- Trade via:

- Web platform.

- Mobile app.

- Broker’s dealing desk.

Requirements

- Thai national ID and house registration or local address.

- Bank book or statement for account linking.

- Tax ID and contact details.

- KYC/suitability questionnaire (experience, objectives, risk tolerance).

Process and trading

- Once approved, clients receive:

- Trading ID and login for the platform.

- Limit or credit line, if margin is approved.

- Orders are sent electronically to the SET:

- T+2 settlement for stocks.

- Corporate actions handled by broker/custodian.

For most Thai residents, local brokerage is the primary and cheapest way to invest in Thai stocks.

How Foreigners Living in Thailand Invest

Foreigners living in Thailand sit between local and non‑resident status.

Residency vs non‑resident from brokerage perspective

- Brokers focus on:

- Whether you can provide Thai address and bank account.

- Whether you pass their KYC and regulatory checks.

- Tax residency (for tax purposes) may differ from brokerage residency classification and must be assessed separately, often with professional advice.

Required documents for expats

Typical requirements (varies by broker):

- Passport.

- Valid visa (e.g., work permit, retirement, long‑stay, or elite visa).

- Proof of Thai address (lease, utility bill, or employer letter).

- Thai bank account details (current/savings).

- Fatca/CRS forms where applicable.

Account opening and funding

- Select a Thai broker that supports foreign individuals.

- Submit application plus documents (in person or online, depending on firm).

- After approval:

- Receive trading account and login.

- Fund the account in THB via local bank transfer.

Trading and restrictions

- Expats can usually trade:

- Local share classes (subject to foreign room).

- NVDRs.

- ETFs and derivatives, if allowed by profile.

- Some brokers may:

- Limit margin for foreign clients.

- Require higher documentation for derivative accounts.

How Foreign Investors Outside Thailand Invest

This is the largest information gap in most SERP content. Non‑resident foreigners have several distinct routes.

1. Foreign brokers with Thai market access

- Many global brokers and private banks offer direct access to SET/TFEX as part of their emerging‑markets coverage.

- Features:

- Trading in THB (or converted from USD/EUR).

- Custody with a global custodian and Thai sub‑custodian.

- Access to foreign share classes and NVDRs where available.

2. Regional platforms and custodians

- Some regional online platforms (in Singapore, Hong Kong, etc.) provide multi‑market trading, including Thailand.

- These often aggregate:

- SET stocks.

- Thai ETFs.

- Thai‑related products (e.g., structured warrants or notes).

3. ETFs and mutual funds

- For many global investors, the simplest route is:

- Broad EM or ASEAN ETFs that include Thai exposure.

- Active funds or UCITS vehicles specializing in ASEAN or Asia ex‑Japan.

- Custody remains in home market, avoiding direct dealings with local brokers, FX, and documentation.

4. DRs and NVDRs via foreign custodians

- International custodians allow institutional clients to hold:

- Thai foreign shares.

- NVDRs when foreign room is tight.

- Economic exposure is equivalent to ordinary shares, except for voting rights in NVDRs.

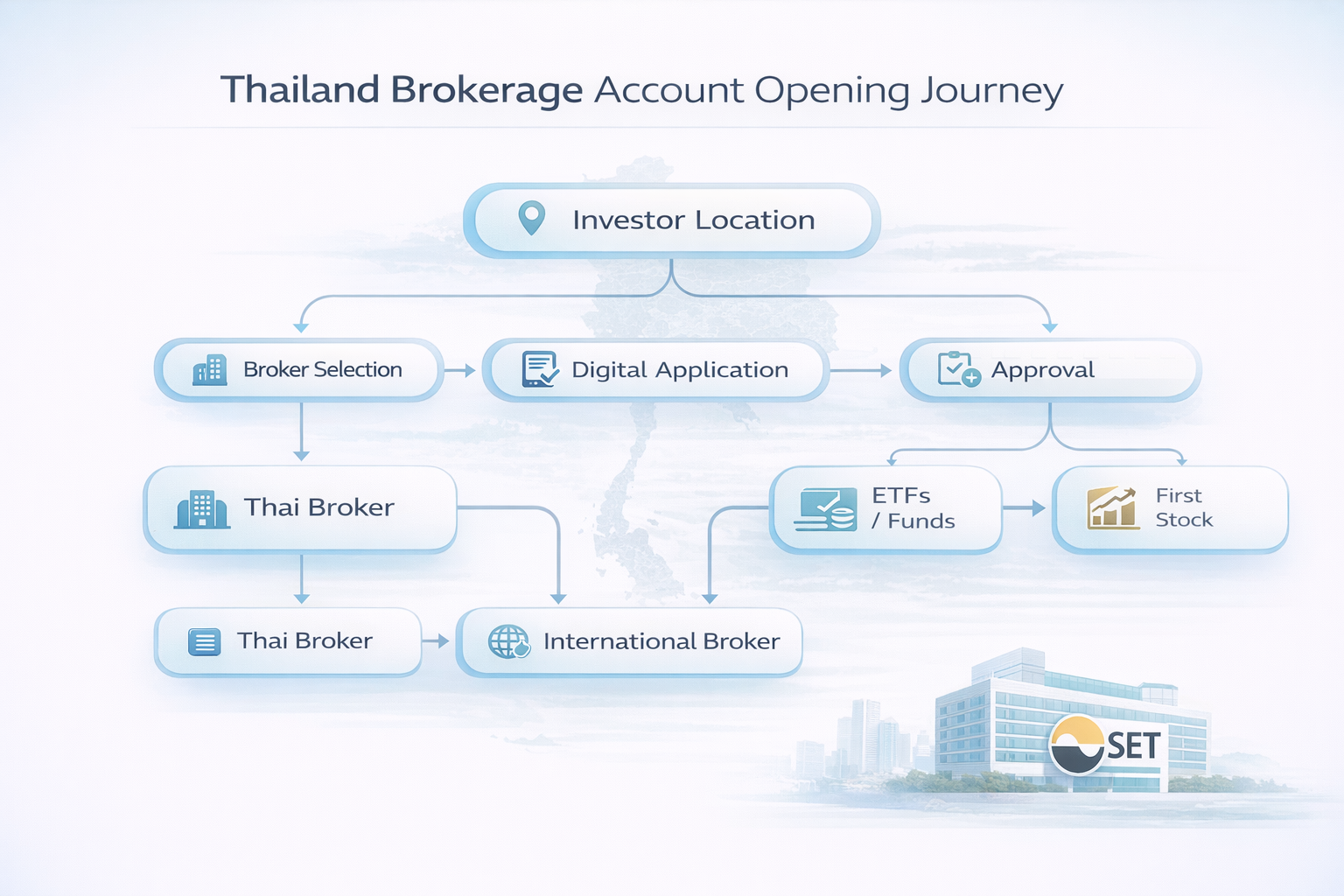

Step‑by‑Step: Opening a Thai Brokerage Account

This process applies mainly to Thai residents and expats opening directly with a Thai broker.

Step 1 – Choose account type and broker

Decide on:

- Cash vs margin account.

- Whether you need access to:

- SET/mai only.

- TFEX derivatives as well.

- Online trading or advisory support.

Step 2 – Gather required documents

Typically:

- Thai: ID card, house registration, bank book/statement, tax ID.

- Foreigner: passport, visa, proof of address, Thai bank account, tax ID (local or foreign).

Step 3 – Submit application

- Complete account forms and KYC/suitability questionnaire (income, assets, experience, risk tolerance).

- Sign agreements for:

- Securities trading.

- Margin (if applicable).

- Derivatives (if applying for TFEX).

Step 4 – Approval and account setup

- Approval timelines vary but typically a few business days if documents are complete.

- Broker provides:

- Trading ID.

- Login credentials for online/mobile platforms.

- Details of settlement account at your bank.

Step 5 – Fund the account

- Transfer THB from your bank to the broker’s designated account:

- Ensure reference details are correct to allocate funds.

- For foreigners funding from abroad:

- Send foreign currency to your Thai bank, convert to THB, then transfer to broker.

Step 6 – Start trading

- Place your first order:

- Choose share vs NVDR.

- Select order type (limit, market, etc.).

- Monitor execution and settlement (T+2).

Thai Brokerage Options for Foreign Investors

Foreign investors can interact with Thai stocks through three main brokerage categories.

1. Local Thai brokers

- Pros:

- Direct access to the full SET/TFEX product set.

- Local research, Thai‑language materials, and corporate‑action handling.

- Often lower local trading commissions.

- Cons:

- Onboarding may require presence in Thailand and Thai bank account.

- Interfaces and documentation may be more Thai‑centric.

2. International full‑service brokers / private banks

- Pros:

- Multi‑market trading from one account.

- Integrated custody and reporting (across Asia/EM).

- FX support and potential tax reporting help.

- Cons:

- Higher minimum assets.

- Commissions and spreads can be higher than local rates.

3. Digital / regional platforms

- Pros:

- Online onboarding, lower minimums, unified interface.

- May offer fractional or small‑ticket access in some cases.

- Cons:

- Not all support SET; coverage may be limited to ETFs or ADR/DR‑style products.

- Product menu may exclude NVDRs or derivatives.

Comparison table (conceptual)

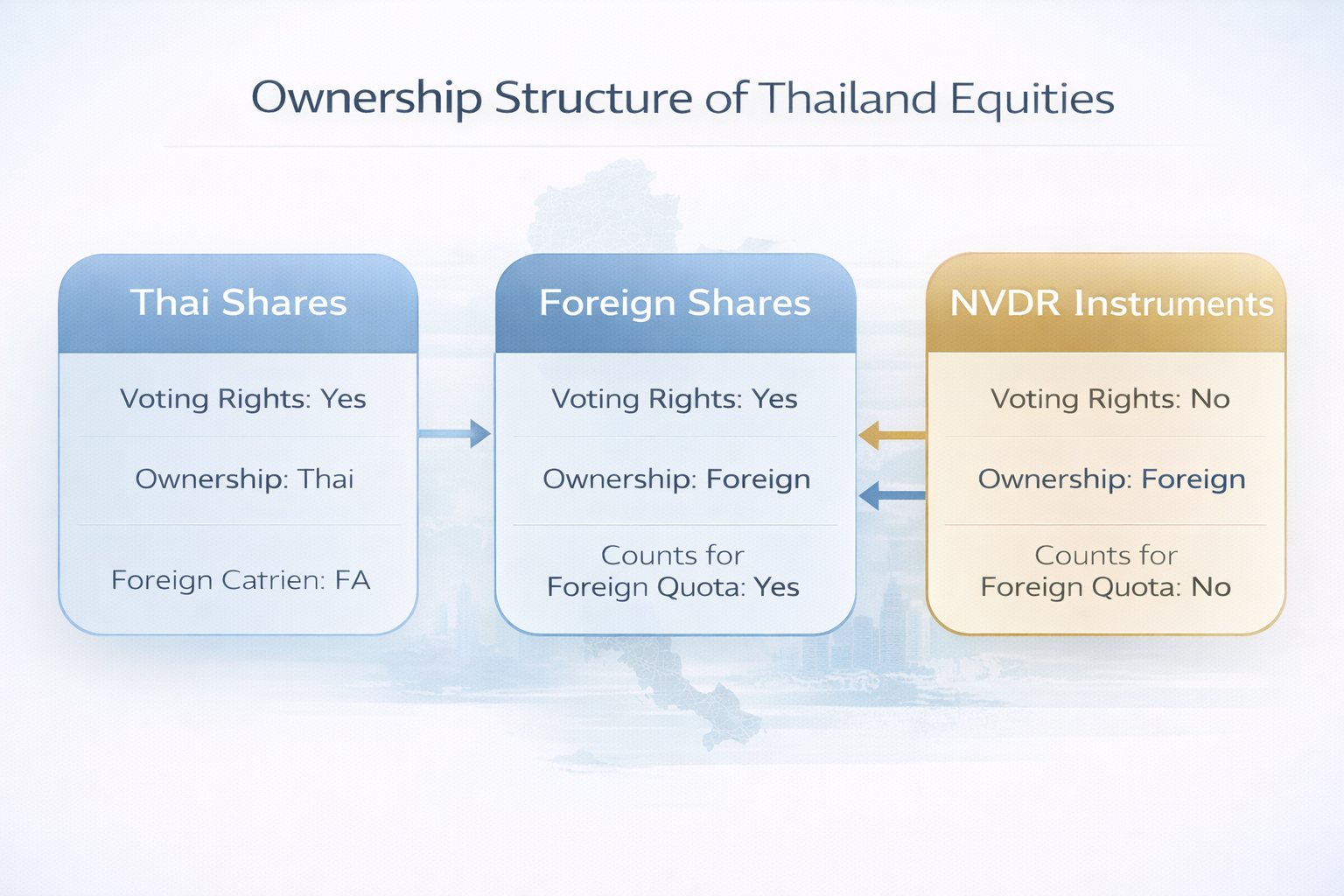

Foreign Ownership Limits, NVDR & Share Types

This is the critical structural topic for foreign investors.

Foreign ownership limits (FOL)

- Many Thai companies, especially in regulated sectors (banks, telecoms, media), impose foreign ownership caps, often at 49% of voting shares.

- SET and brokers show:

- Foreign limit (maximum).

- Foreign holding (current).

- Foreign room (remaining capacity).

When foreign room is full, foreign investors cannot buy additional foreign shares, but they can still access economic exposure via NVDRs.

Local shares vs foreign shares vs NVDR

Thai equities often exist in these forms:

- Local shares (L‑shares)

- Foreign shares (F‑shares)

- Shares designated for foreign shareholders, counted against foreign ownership limits.

- Give full voting and economic rights, but subject to foreign room constraints.

- Non‑Voting Depository Receipts (NVDRs)

- Issued by Thai NVDR Co., Ltd., trade alongside ordinary shares.

- Provide full economic benefit: dividends, rights, and capital gains in the same way as underlying shares.

- No voting rights, so do not increase foreign control and are not counted toward FOL.

- Can be converted to foreign or local shares (subject to room), offering flexibility.

Liquidity and pricing

- NVDRs trade on the same board, same price, and same liquidity pool as local shares, so spreads and depth are usually similar.

- In practice, foreign investors often prefer NVDRs even before foreign room is full, due to flexibility and simplicity.

Costs of Investing in Thai Stocks

Brokerage commissions and trading fees

- Commission rates vary by broker, volume, and account type; Thai retail rates are often a small fraction of trade value (with minimum ticket sizes).

- Additional charges can include:

- Exchange fees and regulatory fees embedded in the commission or charged separately.

- Custody or account fees for foreign clients or institutions.

Taxes on dividends and capital gains (cash side, details in next section)

- Dividends from Thai companies:

- Typically subject to 10% withholding tax for individuals, including foreigners.

- Capital gains:

- Policy can differ depending on whether the investor is a Thai resident, a foreign company, or a foreign individual, and whether they are carrying on business in Thailand.

FX and funding costs

- Foreign investors face:

- FX conversion spreads when moving funds into THB and back.

- Potential bank transfer fees and correspondent bank charges.

Taxes on Thai Stock Investments

Tax treatment depends on investor type, residency, and treaty status. Always confirm with a qualified tax adviser; what follows is a high‑level outline.

Thai tax on dividends

- Standard withholding tax on dividends from Thai companies is 10%.

- For Thai residents:

- For non‑resident individuals:

- 10% dividend withholding typically applies; relief may be available under double taxation treaties depending on home country.

Capital gains tax

- For Thai companies and residents, capital gains on shares are generally treated as taxable income, with some exemptions and nuances.

- For foreign companies not carrying on business in Thailand, Thai tax guidance indicates that capital gains from disposal of investments derived from or in Thailand can be taxed at 15%, subject to treaty relief.

- Many retail foreign investors trading via foreign brokers rely on:

- Local rules in their home jurisdictions.

- Treaty provisions that may reduce or relieve Thai source capital gains tax.

- Actual practice can be complex and fact‑specific, making professional advice critical.

Double taxation treaties and foreign tax credit

- Thailand maintains multiple double taxation treaties; these:

- May reduce withholding tax rates on dividends.

- Clarify which country has primary taxing rights on capital gains.

- Home‑country rules often allow foreign tax credits for Thai withholding taxes.

Risks of Investing in Thailand Stock Market

Emerging‑market and macro risk

- Thailand is an emerging market with exposure to:

- Tourism shocks.

- Political developments.

- External demand and global risk appetite.

Liquidity risk

- Liquidity is high in SET50/SET100 names, but can be limited in smaller SET and mai stocks, leading to wider spreads and higher impact costs.

Governance and regulatory risk

- Governance quality varies; while major blue chips and ESG‑rated firms follow high standards, smaller issuers can present higher governance risk.

- Regulatory changes (e.g., foreign investment rules, short‑selling constraints) can alter market dynamics.

Currency and FX risk

- Foreign investors are exposed to Thai Baht (THB) fluctuations against their home currency.

- FX moves can offset or amplify stock‑price returns.

Foreign room and structural constraints

- FOL and foreign room can:

- Limit the ability to acquire or increase positions in certain companies.

- Affect pricing between foreign shares, local shares, and NVDRs in special situations.

Practical Example: Buying a Thai Stock

Below is an illustrative walkthrough for a foreign investor living in Thailand interested in buying AOT (Airports of Thailand).

- Open Thai brokerage account

- Choose a Thai broker that accepts foreigners with your visa type.

- Provide passport, visa, proof of address, bank details, and complete KYC.

- Fund the account

- Check foreign room and NVDR

- On the SET or broker platform, check:

- AOT foreign room.

- Availability and ticker of AOT NVDR (e.g., AOT‑R).

- On the SET or broker platform, check:

- Decide on share class

- If foreign room is available and you want voting rights, you may choose foreign shares (if designated).

- If foreign room is tight or you do not need voting rights, use AOT NVDR for full economic exposure.

- Place an order

- Enter ticker (AOT or AOT‑R), order type (limit), quantity, and price.

- Submit order during normal trading hours; monitor execution.

- Settlement and corporate actions

- On T+2, cash debits and securities credit to your account.

- Dividends and rights, if any, will be credited to your account in THB, with any applicable withholding.

Best Strategies for Investing in Thailand

Index‑based core

- Use SET50 or SET100 ETFs or index funds as a core allocation for diversified, large‑cap exposure.

- This reduces single‑stock risk while capturing the broad Thai equity premium.

Sector diversification

- Overlay sector tilts based on your macro views:

- Tourism and transport (AOT, airlines) for travel recovery themes.

- Banks for credit and rate cycles.

- Energy and petrochemicals for commodity and regional growth themes.

- Healthcare for defensive growth and medical tourism.

Dividend and income strategies

- Focus on:

- High‑dividend telecoms, utilities, and selected banks.

- REITs and property funds for yield.

ASEAN and EM context

- Embed Thai exposure within a broader ASEAN or EM allocation to:

- Diversify country‑specific political and currency risk.

- Capture regional integration trends.

Active vs passive

- Passive: Index funds and ETFs for low‑cost market exposure.

- Active: Sector rotation, stock picking in under‑researched mid‑caps and growth names, and tactical use of TFEX for hedging.

Common Mistakes Foreign Investors Make

- Ignoring foreign ownership limits

- Buying into names where foreign room is nearly full without understanding conversion and NVDR dynamics.

- Overlooking NVDR benefits

- Avoiding NVDRs due to unfamiliarity, missing a practical route to economic exposure.

- Underestimating FX and liquidity risk

- Focusing solely on stock selection while ignoring THB risk and the liquidity profile of smaller names.

- Assuming tax rules are identical to home market

- Not accounting for Thai dividend withholding, potential capital‑gains exposure, and treaty implications.

- Concentrating only on tourism or a single theme

- Overweighting a single sector (e.g., airports or hotels) without balancing with financials, consumer, and other sectors.

FAQ: Investing in Thailand Stocks

Can foreigners invest in Thai stocks?

Yes. Foreigners can invest:

- Directly via Thai or international brokers.

- Indirectly via NVDRs, ETFs, and funds.

Can I invest in Thai stocks from abroad?

Yes. Options include:

- Global brokers with SET access.

- Regional platforms.

- ETFs and funds with Thai allocations.

- Institutional investors may also hold foreign shares or NVDRs via global custodians.

What is the minimum investment?

- Thai brokers often allow relatively small trade sizes (e.g., one board lot), but:

- Minimum deposit requirements vary.

- International brokers and private banks may impose higher minimum assets.

How are Thai dividends and capital gains taxed for foreigners?

- Dividends: typically 10% withholding tax, subject to treaty relief.

- Capital gains: treatment depends on investor type and structure; foreign companies not carrying on business in Thailand may face 15% tax on capital gains, subject to treaties and specific circumstances.

What is NVDR?

- NVDR (Non‑Voting Depository Receipt) is a listed instrument that:

- Mirrors the price and economic benefits of underlying Thai shares.

- Carries no voting rights, so does not count toward FOL.

- Is specifically designed to allow foreign investors to invest even when foreign room is full.

Which brokers can I use?

- Thai residents and expats can use Thai securities firms and bank‑affiliated brokers.

- Non‑resident foreigners can use:

- International brokers with Thai access.

- Regional multi‑market platforms.

- ETF/fund providers for indirect exposure.

This guide outlines the structures, pathways, costs, and constraints involved in investing in Thai equities. For specific tax, legal, or portfolio decisions, investors should combine this framework with current SET information, broker disclosures, and qualified professional advice.