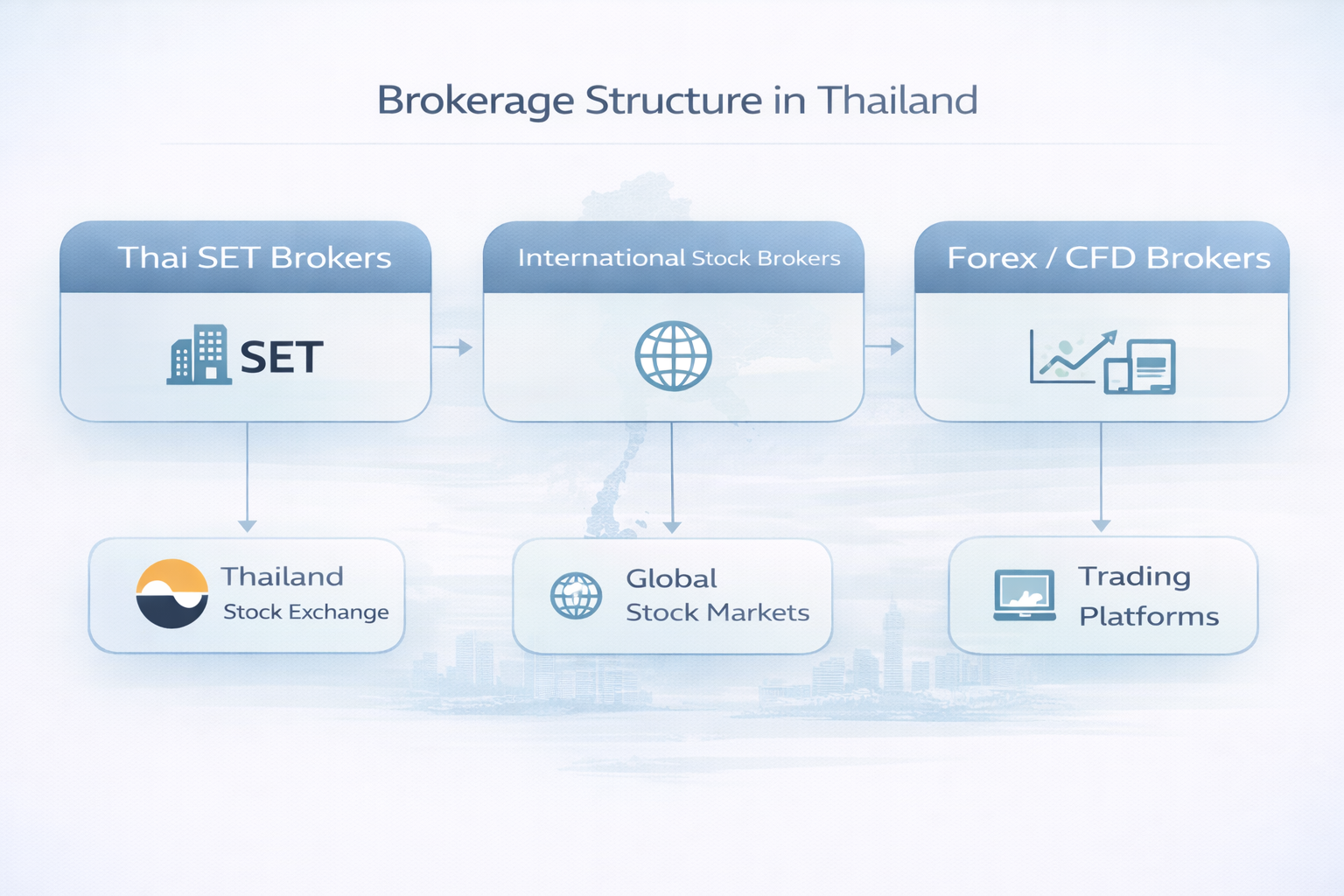

Thailand’s stock brokerage landscape includes 36 direct SET member firms for local trading, plus international brokers offering Thai equities via global platforms. This comparison focuses on SET stock access, distinguishing regulated Thai brokers from international and forex alternatives.

How Stock Brokerage Works in Thailand

SET access model

- Only SET member companies (36 as of 2026) can directly execute trades on the Stock Exchange of Thailand (SET) and mai.

- These members are licensed by the Thai Securities and Exchange Commission (SEC) as securities companies.

Local brokers and intermediaries

- Thai residents and qualified expats trade via SET members, which provide:

- Direct order routing to SET’s electronic trading system.

- Settlement via TSD (Thai Securities Depository) on T+2.

- Brokers act as:

- Agents (execute client orders).

- Principals (proprietary trading).

Custodians and post‑trade

- Brokers typically provide custody for retail clients; larger institutions use dedicated custodians.

- SIPF (Securities Investor Protection Fund) protects clients up to 1 million THB per broker in case of member default (31 of 36 SET members participate).

Foreign brokers

- International brokers access SET via Thai sub‑brokers or global custodians with Thai sub‑custody.

- They offer Thai stocks as part of multi‑market offerings, often with NVDR support for foreign ownership limits.

Trading infrastructure

- SET’s New Trading System (NTS) supports electronic matching with auctions and continuous trading.

- Brokers connect via FIX protocols or proprietary APIs; clients use web/mobile apps.

Types of Brokers Available in Thailand

Thai stock brokers (SET members)

- Direct SET members (36 firms): Execute SET/mai/TFEX trades, provide local research, Thai‑language support.

- Examples: Kiatnakin Phatra, Daol Securities, Aira Securities.

International stock brokers

- Global firms offering Thai equities as part of EM/Asia coverage:

- Interactive Brokers, Saxo Bank, Trading 212, XTB.

- Access SET via partnerships; suitable for multi‑market investors.

Forex/CFD brokers

- Offer CFD contracts (derivatives) on Thai stocks, indices, and forex.

- Not direct SET access; no ownership of underlying shares.

- Examples: IC Markets, Admirals, Oanda (often regulated offshore).

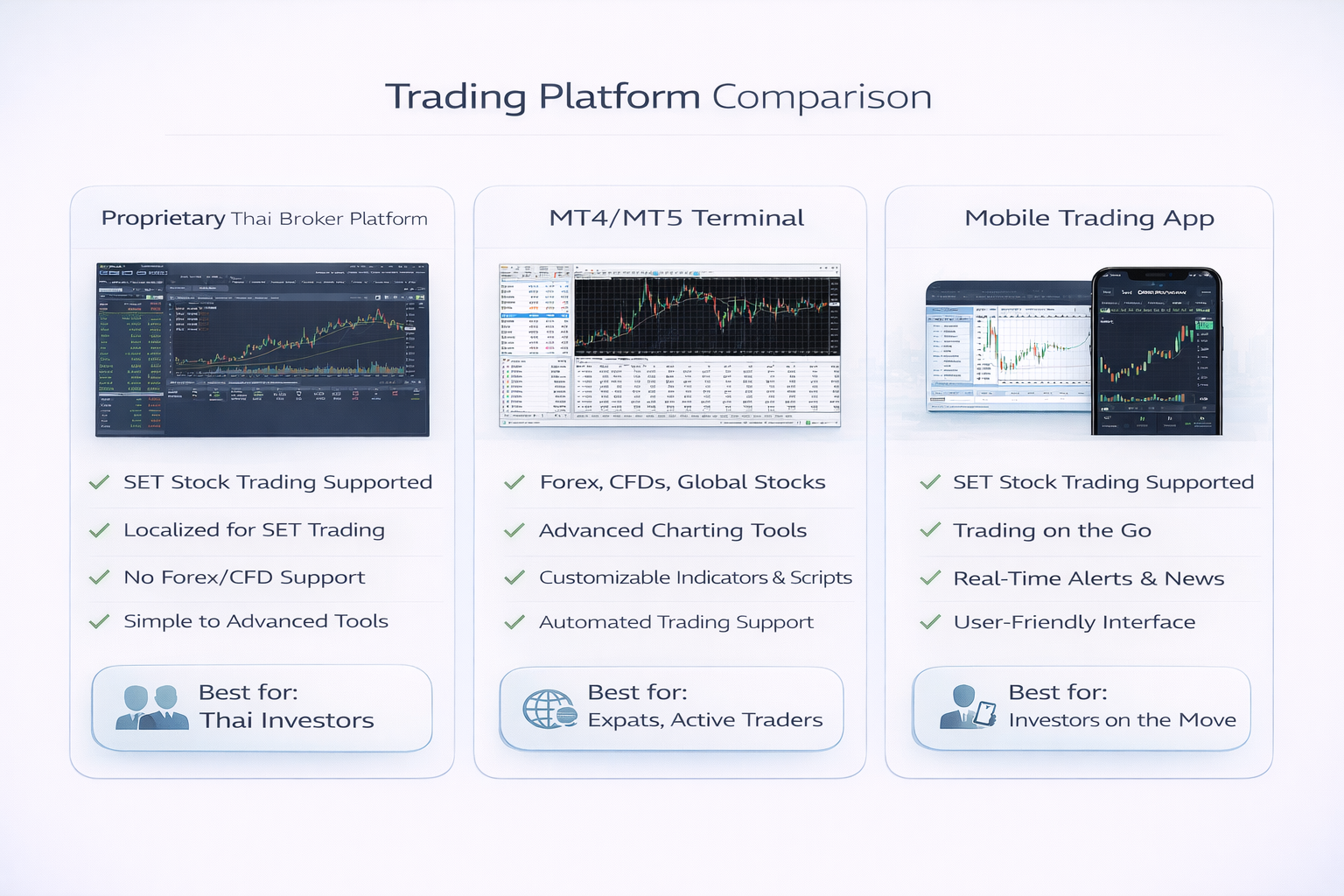

Trading platforms

- Proprietary platforms from brokers (e.g., broker web/mobile apps).

- Third‑party like MT4/MT5 (mainly for forex/CFDs).

Key difference: Stock brokers give direct ownership; forex/CFD brokers provide leveraged price exposure without custody.

Best Thai Stock Brokers (SET Members)

Thailand has 36 SET member brokers (31 with internet trading, 31 SIPF members).

Major Thai brokers overview

These are among the largest and most active SET members:

- Kiatnakin Phatra Securities (KKP)

- Ownership: Kiatnakin Phatra group.

- Strengths: Research, institutional coverage, online trading.

- Investor type: Thai residents, qualified expats, institutions.

- Platforms: Web, mobile app.

- Minimum deposit: Low (often none beyond first trade).

- Daol Securities (DAOLSEC)

- Aira Securities (AIRA)

Other notable SET members include Kasikorn Securities (KSecurities), Bualuang Securities, and Phillip Securities (Thailand).

Fees example (Kasikorn Securities)

- Commission: Based on daily trading value + SET fee 0.005% + TSD 0.001% + regulatory 0.001% + 7% VAT.

- Typical retail: ~0.25% round‑trip (0.125% each way) + minimum per order.

For full list and details, visit SET member directory.

Best International Brokers for Thailand Investors

These brokers provide Thai stock access for Thai residents, expats, and global investors.

Top international options

- Interactive Brokers (IBKR)

- Saxo Bank

- Thai stocks: Yes.

- Global markets: Extensive.

- Custody: Multi‑asset custody.

- Funding: Multi‑currency.

- Suitability: HNW, professionals.

- Trading 212

- Thai stocks: Limited (ETFs or select).

- Global markets: 10,000+ instruments.

- Custody: Zero commission focus.

- Suitability: Retail beginners.

- XTB

- Thai stocks: Yes, CFDs and direct.

- Global markets: Stocks, forex.

- Custody: EU regulation.

- Suitability: Active traders.

These brokers typically support NVDRs and foreign shares, with THB trading where possible.

Forex Brokers vs Stock Brokers in Thailand

The phrase “forex brokers vs stock brokers” highlights a key distinction for Thai investors.

CFD vs real stocks

- Stock brokers: Buy actual shares on SET (ownership, dividends, voting where applicable).

- Forex/CFD brokers: Offer contracts for difference (CFDs) on Thai stock prices:

- No ownership; leveraged bets on price moves.

- No dividends, voting, or corporate actions.

Risks and regulation

- CFDs carry high leverage risk (up to 1:30), potential for rapid losses.

- Many forex brokers are offshore (e.g., Seychelles, Cyprus); not licensed by Thai SEC for SET trading.

- IC Markets, Admirals: Popular for forex/CFDs but no direct SET access; use for Thai index CFDs only.

When relevant

- Forex/CFDs suit short‑term trading/speculation.

- Stock brokers for long‑term investing, dividends, and ownership.

Broker Comparison Table (Thailand 2026)

Trading Platforms Available in Thailand

Proprietary platforms

- Thai brokers: Custom web and mobile apps with Thai interface, SET order types, real‑time quotes.

- International: TWS (IBKR), SaxoTrader, integrated research/tools.

MT4/MT5

- Primarily for forex/CFD brokers (IC Markets, Admirals).

- Not standard for SET stock trading; used for derivatives or CFDs.

Web and mobile trading

- 31 of 36 SET members offer internet trading.

- Mobile apps dominant for retail; web for institutions.

Regulation of Brokers in Thailand

Thai SEC licenses

- Brokers must hold securities business licenses (Type A–E):

- SET membership required for direct trading.

Investor protection

- SIPF: Up to 1 million THB per client per broker.

- Client assets segregated; fit‑and‑proper tests for directors.

Offshore risks

- International brokers: Regulated in home jurisdiction (FCA, ASIC), but Thai investors have limited recourse via SIPF.

- Forex brokers: Often offshore; high risk of loss in disputes.

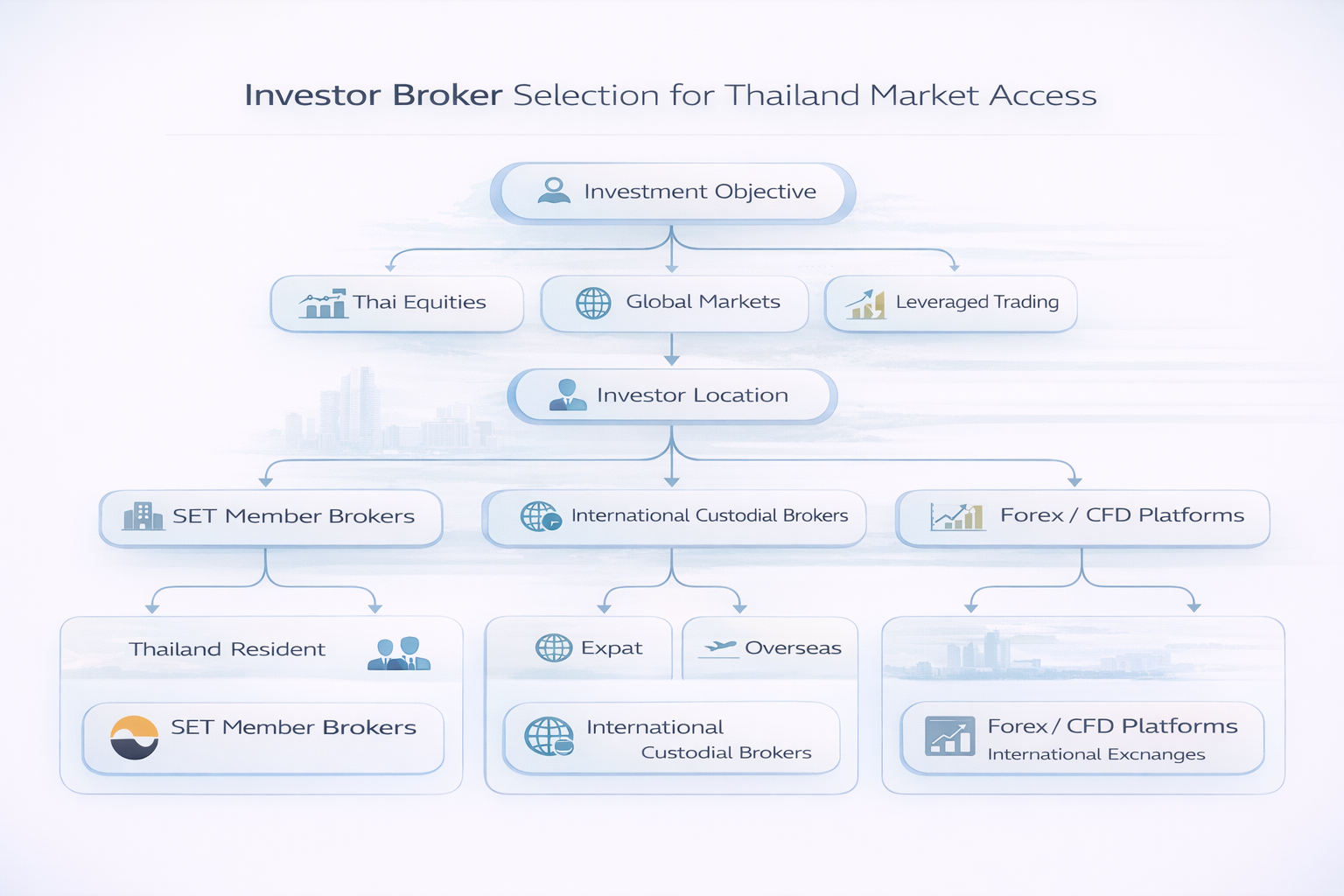

How to Choose a Broker in Thailand

Decision framework

- Thai stocks only (long‑term): Local SET member (low fees, SIPF).

- Global stocks + Thai: International (IBKR, Saxo).

- Forex/short‑term: CFD broker (high leverage).

- Day trading: Low‑latency international (IBKR).

- Expats/foreigners: Broker with easy onboarding (Trading 212, local with Thai bank support).

Costs of Using Brokers in Thailand

Commissions

- Thai brokers: 0.15–0.25% of trade value + 7% VAT + exchange fees (~0.007%).

- International: Tiered (IBKR low for volume); flat or % + spreads.

Spreads and FX

- Local: Minimal (exchange‑driven).

- International: FX conversion costs (0.1–1%).

Custody and inactivity

Minimum Deposit Requirements by Broker Type

- Thai SET brokers: Often none or low (e.g., enough for first trade).

- International stock brokers:

- IBKR: USD 0 for cash accounts.

- Saxo: USD 2,000+.

- Trading 212: Low/none.

- Forex/CFD: USD 100–500 (IC Markets ~USD 200).

Which Broker Is Best for Different Investors

Thai residents

- Local SET member (e.g., Kasikorn, KKP): Lowest fees, Thai support, SIPF.

Expats in Thailand

- Local broker with foreign onboarding or international like IBKR/Saxo.

Foreign investors abroad

- Interactive Brokers or Saxo: Multi‑market with Thai access.

Traders (day/short‑term)

Long‑term investors

Risks of Using Offshore Forex Brokers in Thailand

- No SIPF protection; limited recourse.

- Leverage amplifies losses; CFDs not suitable for long‑term holding.

- Offshore regulation weaker than Thai SEC or FCA/ASIC.

- Potential marketing as “stock brokers” despite CFD‑only access.

FAQ: Brokers in Thailand

What is the best broker in Thailand?

Depends on needs: Local SET members for Thai stocks; Interactive Brokers for global access.

Can foreigners open a broker account in Thailand?

Yes, expats with visa/address can use local brokers; non‑residents use international.

How do international brokers access SET?

Via custodians and Thai sub‑brokers.

Is forex trading legal in Thailand?

Yes, but offshore forex/CFD brokers are not SEC‑regulated for SET; use licensed firms.

What is the minimum deposit for Thai brokers?

Often none/low for local brokers.

This comparison is based on publicly available data as of 2026. Investors should verify current terms, licenses, and suitability with brokers directly.