Thailand allows both local and foreign investors to access its stock market through a relatively modern, exchange-based system with clear rules, specific foreign ownership limits, and several practical routes (local brokers, NVDRs, and offshore ETFs) that make Thai equities accessible from abroad.

Thailand Stock Market: How It Works, Who Can Invest, and Step-by-Step Guide for Foreign Investors

What Is the Thailand Stock Market?

The core of the Thai securities market is the Stock Exchange of Thailand (SET), which operates the main board for larger Thai listed companies and the Market for Alternative Investment (mai) for smaller growth firms. Together they host common stocks, real estate investment trusts (REITs), infrastructure funds, exchange-traded funds (ETFs), and some foreign-incorporated companies that are primary-listed in Thailand. The Thailand Futures Exchange (TFEX) provides derivatives such as equity index futures, single-stock futures, and other contracts, complementing the cash equity market.

Thailand is classified as an emerging market and is one of the larger stock markets in Southeast Asia by market capitalization. Recent regional comparisons place SET’s market cap around US$500–515 billion with about 600–640 listed companies, making it roughly the third-largest exchange in ASEAN after Indonesia and Singapore by size. The Thai stock market represents a diversified real economy across energy, banking, tourism and transport, retail and commerce, healthcare, property, and technology sectors.

Thailand vs ASEAN stock markets

Using recent regional data (2024 estimates):

This positioning means Thai equities are a meaningful but not dominant weight in regional ASEAN equity and emerging market Thailand indices, which matters for global portfolio construction.

(Visual to include: comparative bar chart of ASEAN market capitalizations showing Thailand’s position vs Indonesia, Singapore, Malaysia, Vietnam.)

How the Thai Stock Market Works

Trading sessions and hours

SET conducts trading on all Thai bank business days, typically Monday to Friday. The equity market has two main sessions, each starting with a call auction (pre-open) followed by continuous trading and ending with a pre-close period:

- Morning:

- Afternoon:

- Pre-close: 4:30 p.m. – random close time T3 (between 4:35–4:40 p.m.) for closing auction.

- Off-hour trade reporting: T3 to 5:00 p.m.

TFEX (derivatives) operates separate day and night sessions with extended hours, but this guide focuses on the cash equity market.

Tick sizes, board lots, and price limits

The Thai stock market uses a price–level-based tick size system and standard board lots:

- Board lot:

- Tick size (minimum price increment) for Thai stock trading:

- < 2 THB: 0.01 THB

- 2 to < 5 THB: 0.02 THB

- 5 to < 10 THB: 0.05 THB

- 10 to < 25 THB: 0.10 THB

- 25 to < 100 THB: 0.25 THB

- 100 to < 200 THB: 0.50 THB

- 200 to < 400 THB: 1.00 THB

- ≥ 400 THB: 2.00 THB

- Unit trusts and ETFs: fixed tick size of 0.01 THB.

There are daily price limits via “ceiling and floor” bands relative to the reference price, as well as dynamic price bands to curb intraday volatility, applied across equities, NVDRs, DRs, warrants, and leveraged/inverse ETFs.

Settlement cycle and post-trade infrastructure

Cash equities on SET settle on T+2 business days through Thailand Clearing House and the Thailand Securities Depository (TSD). A standard domestic trade involves:

- Trade execution on SET through a member broker.

- Netting and clearing through the central counterparty (TCH).

- Final settlement via T+2 delivery-versus-payment, with securities held in segregated client accounts at TSD.

Foreign investors may use special non-resident baht accounts for securities (NRBS) or foreign currency accounts at designated banks, with NRBS balances capped at THB 200 million per investor under Bank of Thailand rules.

Order types and market participants

SET operates an electronic central limit order book with call auctions for open/close and continuous matching intraday, supporting standard order types such as limit and various conditional orders (e.g. at-the-open/at-the-close) depending on broker front-ends.

Key participants include:

- Domestic retail investors and proprietary traders.

- Local institutions (mutual funds, insurance, pension funds).

- Foreign investors (foreign institutions, offshore funds, and individuals) accessing the Thai securities market via F-shares, NVDR, and DR structures.

Main indices: SET, SET50, SET100

- SET Index: Broad market-cap-weighted index covering all eligible common stocks listed on SET, excluding some fund vehicles; it is the main Thai stock market benchmark.

- SET50 / SET50FF:

- SET100 / SET100FF:

These indices are reviewed semi-annually, with liquidity, market cap, and other criteria to ensure investability. SET also maintains sector and thematic indices such as SETWB (tourism- and consumption-related sectors attractive to foreign investors).

(Visual to include: Thai market structure diagram showing investors → brokers → SET cash market & TFEX → clearing house (TCH) → depository (TSD); with indices overlaid on the equity segment.)

Can Foreign Investors Buy Thai Stocks?

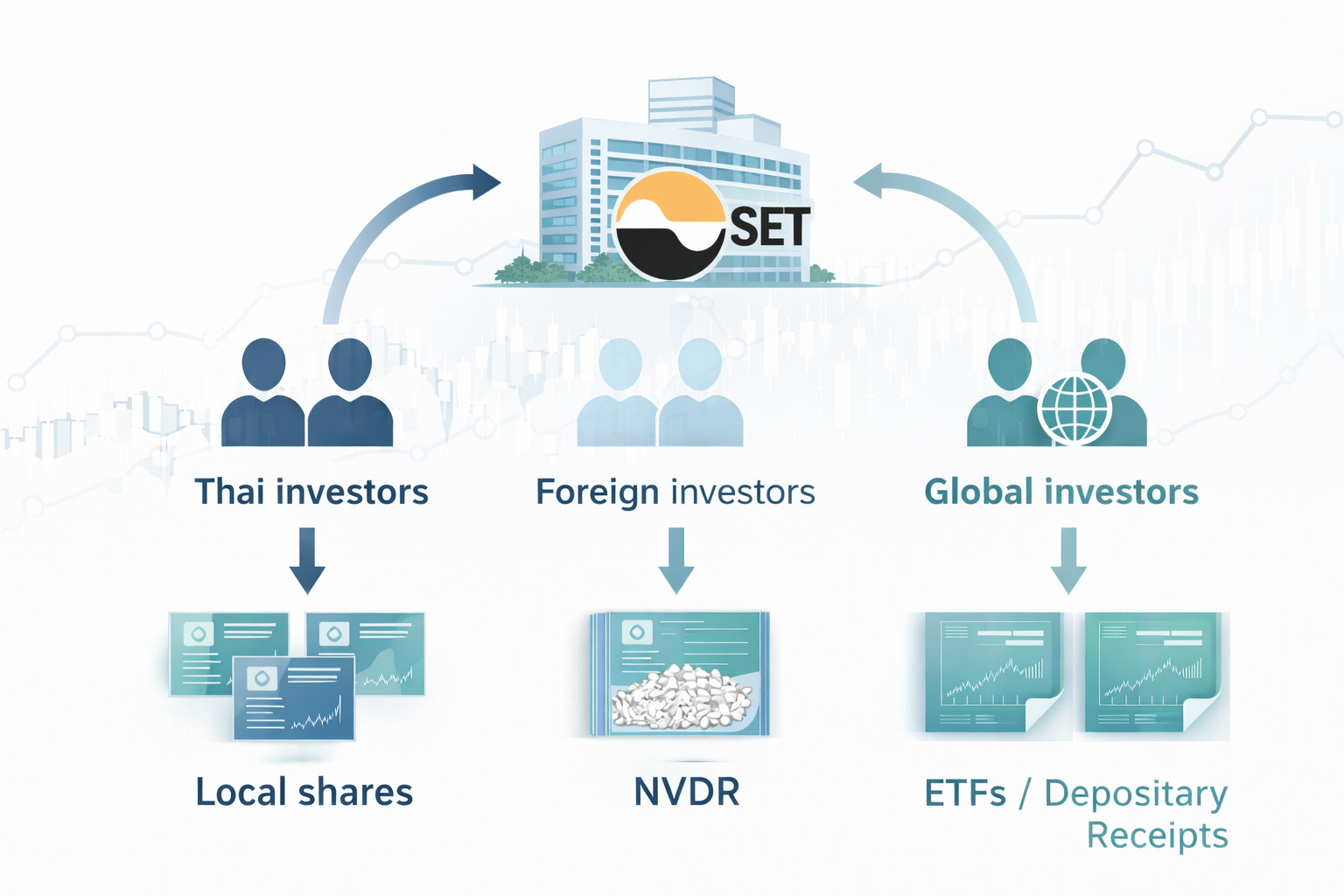

Eligibility and basic routes

Thailand explicitly allows foreign investors to participate in its stock market, though foreign ownership of Thai listed companies is capped at specific levels. Foreigners can access Thai listed companies through several instruments:

- Foreign shares (F-shares) registered on the foreign board, counting against foreign ownership limits but with full voting and economic rights.

- Non-Voting Depository Receipts (NVDRs), which give full economic exposure to the underlying Thai stock (dividends, rights, capital gains) but no voting rights and do not count toward foreign ownership caps.

- Local shares (L-shares) in some circumstances (primarily for Thai nationals), but non-Thai individuals are generally expected to hold F-shares or NVDRs instead.

Foreign investors must appoint a Thai broker and often a local custodian/correspondent bank to handle settlement, custody, and currency conversion. Funds can be brought in freely for investment purposes, subject to standard anti–money laundering checks and capital flow reporting, with repatriation of sale proceeds allowed upon proof of the underlying transaction.

Residency vs non-residency

There are practical differences between investors resident in Thailand (e.g. expats with long-term visas) and non-resident foreign investors:

- Residents typically open onshore Thai brokerage and bank accounts in their personal name, similar to local investors, and trade local, F, and NVDR shares directly.

- Non-residents (offshore funds, foreign institutions, and many individual foreign investors) may:

- Trade via a Thai broker with custody through a global or Thai custodian bank; or

- Trade Thai stocks (or Thai exposure) via international brokers offering direct SET access, depositary receipts, or Thai/ASEAN ETFs.

Foreign institutional investors almost always use F-shares and NVDRs via custodial structures, while foreign individuals can more flexibly use NVDRs or F-shares.

High-level decision tree for foreign investors

Text-based decision framework:

- Where are you based and what is your status?

- If you are an expat living in Thailand with a long-term visa or work permit:

- Consider opening a Thai brokerage account directly, linked to a Thai bank account.

- If you are non-resident (living abroad):

- If you are an expat living in Thailand with a long-term visa or work permit:

- What level of control and corporate rights do you need?

- Require voting rights and direct shareholding:

- Use F-shares (subject to foreign room availability and potential premiums).

- Economic exposure is sufficient (no need to vote):

- Use NVDRs to avoid foreign ownership limits and simplify execution.

- Require voting rights and direct shareholding:

- Ticket size and complexity tolerance

- Small tickets / learning phase:

- Thai-focused ETFs (in your home market) or NVDRs via a broker are typically simpler.

- Larger tickets / institutional mandates:

- Combine F-shares and NVDRs through a custodian, with NRBS or foreign currency accounts for efficient capital flows.

- Small tickets / learning phase:

(Visual to include: investor pathway flowchart branching by residency (Thailand vs abroad), then by route (Thai brokerage vs international broker vs ETF), then by instrument (F-share vs NVDR vs ETF).)

Foreign Ownership Limits, NVDRs & Share Classes

This is the main structural nuance of the Thai stock market and critical for foreign investors.

Foreign ownership limits and F-shares

Thai law and sector-specific regulations impose maximum foreign ownership limits on Thai listed companies:

- Most sectors: foreign ownership cap around 49% of outstanding shares.

- Banking and some financial institutions: stricter limits around 25%.

To manage these caps, SET uses dedicated foreign-registered shares (“F-shares”) for each company:

- F-shares represent the same economic interest as local shares but are registered as foreign-held and count toward the foreign limit.

- When foreign room (the remaining allowance under the cap) is tight or full, F-shares can trade at a premium to local shares because foreign investors compete for limited capacity.

NVDRs (Non-Voting Depository Receipts)

NVDRs are issued by Thai NVDR Company Limited (a SET subsidiary) to give investors economic exposure to Thai listed companies without affecting foreign room:

- NVDR holders receive:

- Full economic rights: dividends, rights issues, capital gains, and other cash distributions equivalent to underlying common stock.

- NVDR holders do not receive:

- Voting rights at shareholder meetings.

- NVDRs trade on SET alongside local shares, and are designed to trade at the same price as the underlying local shares, allowing straightforward arbitrage and tracking.

- NVDR holdings do not count toward legal foreign ownership limits, so foreign investors can continue to buy NVDRs even when foreign room is fully used.

Conversion between NVDRs and foreign shares is possible through the post-trade system, subject to foreign room availability:

- NVDR → F-shares:

- F-shares → NVDRs:

- Typically done via the trading and clearing system by first converting F-shares into local shares and then into NVDRs, with associated brokerage commissions.

Local (L), Foreign (F), NVDR (R) – practical comparison

Based on SET and practitioner guidance:

When NVDRs trade at premium or discount

Because NVDRs represent purely economic rights without votes and are intended to track local shares, in a frictionless market they should trade at or very close to the price of the underlying L-shares.

In practice:

- NVDRs can occasionally trade at a small discount if some investors place a positive value on voting rights or if there is temporary technical selling pressure in NVDRs.

- F-shares, not NVDRs, are more commonly associated with sustained premiums when foreign room is tight and institutions are constrained to use F-shares.

For most portfolio strategies where corporate control is not the objective, NVDRs are the cleanest way for foreign investors to access Thai equities.

(Visual to include: NVDR vs share diagram showing underlying Thai listed company → L-shares / F-shares; Thai NVDR Company holding L-shares and issuing NVDRs to investors, with arrows indicating economic flows but no voting rights.)

How to Invest in the Thailand Stock Market (Step-by-Step)

There are two main paths for foreign investors: opening a Thai brokerage account (onshore route) or gaining exposure via foreign brokers and Thai-focused funds/ETFs (offshore route).

H3 — Opening a Thai Brokerage Account

This path is most relevant for expats resident in Thailand or investors comfortable completing Thai KYC and banking procedures.

1. Choose a Thai broker

SET maintains a list of member firms that provide trading access, research, and in some cases English-language support. When comparing brokers, foreign investors should look at:

- Commission rates: Thai brokerage fees for equities typically range around 0.05–0.25% per side depending on volume and channel.

- Platform language and support: Availability of English-language trading interfaces, research, and customer service.

- Custody arrangements: How client assets are held at TSD (segregated accounts) and reporting standards.

2. Prepare documents and open accounts

Typical requirements (exact lists vary by broker):

- Passport and secondary ID.

- Long-term visa or work permit for Thailand (many Thai brokers expect some form of stable local status, especially for retail onshore accounts).

- Proof of local address (utility bill, rental contract) if resident.

- Tax identification numbers (Thai and/or home country depending on FATCA/CRS).

- Bank account in Thailand for THB settlement and transfers (or NRBS/foreign currency accounts for larger non-resident flows).

Some brokers facilitate non-resident accounts where custody is held in the investor’s name but bank accounts are structured via designated Thai banks under non-resident regulations.

3. Fund your account

Foreign investors can:

- Transfer foreign currency and convert to THB through the Thai bank or custodian.

- Use a Non-resident Baht Account for Securities (NRBS) to hold THB, subject to an overall cap of THB 200 million per non-resident investor, as set by the Bank of Thailand.

- Maintain foreign currency accounts with designated banks when operating at institutional scale.

4. Trade Thai stocks

Once the account is live:

- Place orders for Thai stock names (L, F, NVDR, ETFs) in board lots of 100 units.

- For foreign investors, brokers will typically map orders to F-shares or NVDRs depending on availability and instructions.

- Trades execute during SET trading hours with T+2 settlement; confirmations and tax/withholding reports are provided by the broker and custodian.

5. Repatriation and reporting

Sale proceeds and dividends can be repatriated upon presentation of transaction evidence to the bank under standard foreign exchange rules. Tax documentation from the broker (e.g., dividend withholding tax) supports home-country tax reporting and any double tax treaty claims.

H3 — Investing via Foreign Broker or ETF

If opening a Thai brokerage is not practical, foreign investors can still access the Thai stock market indirectly.

1. Direct SET access via international brokers

Some international multi-market brokers (including in Singapore, Hong Kong, and other jurisdictions) offer direct trading on SET and TFEX:

- Investors open an account in their home jurisdiction.

- The broker routes orders to SET through Thai member firms or omnibus arrangements.

- Custody is held in nominee form with a global custodian, and the investor’s beneficial ownership is recorded internally.

This route provides direct exposure to Thai names, often via NVDRs or F-shares, without needing a Thai bank account, though fees and FX spreads vary.

2. Thai and ASEAN ETFs / DRs

A simpler route is to buy Thai exposure through:

- Thailand-focused ETFs or exchange-traded funds tracking SET, SET50, or thematic Thai indices, usually listed in major markets like the US, Europe, Singapore, or Hong Kong.

- ASEAN or emerging Asia ETFs where Thailand is a significant portfolio weight.

- American or global depositary receipts (ADRs/GDRs) for selected large Thai companies if available, traded on foreign exchanges; these mirror underlying Thai equities and can be integrated into foreign portfolios.

This approach avoids dealing with Thai brokerage requirements, but reduces granularity and may involve additional fund-level fees.

Thai Brokerage Options for Foreign Investors

Instead of focusing on specific companies, it is more useful to think in categories of thai brokerage access for foreign investors.

Key practical points:

- For hands-on Thai stock picking, a broker with reliable NVDR/F-share access and clear foreign room reporting is essential.

- For simple, diversified Thai exposure, offshore ETFs via an existing global broker are usually the least operationally complex.

Taxes on Thai Stocks for Foreign Investors

Tax treatment depends on residency, legal form (individual vs juristic person), and the on-exchange vs OTC nature of transactions.

Capital gains

For foreign individual investors who do not carry on business in Thailand and trade listed Thai stocks on SET or TFEX:

- Capital gains from sales of listed shares on SET are generally exempt from Thai personal income tax.

- If trades occur over-the-counter (OTC) or the investor resides in a country without a double taxation agreement (DTA) with Thailand, a 15% withholding tax may apply.

For foreign juristic persons (companies):

- Gains from selling listed shares may be subject to corporate income tax (CIT) and, in some cases, withholding tax if no relevant DTA applies; a 15% rate is commonly cited for capital gains without DTA relief.

Dividends

Dividend income on Thai shares is taxed at source via withholding tax:

- Foreign individuals not conducting business in Thailand:

- Dividends from Thai companies are generally subject to 10% withholding tax.

- Foreign juristic investors:

- Also typically subject to 10% WHT on dividends, though certain shareholding thresholds (e.g., ≥25% of voting shares with holding-period conditions) and BOI-promoted companies can provide exemptions or relief.

Double tax treaties between Thailand and many countries can reduce withholding tax rates or provide methods to credit Thai tax against home-country liabilities.

Interest and other income

Interest on Thai bonds or cash balances is generally subject to 15% withholding for foreign investors, with some exemptions for government or financial institution bonds and where DTAs apply.

Gains from Thai debt or derivative instruments may be taxed differently depending on instrument type and whether positions are held on- or off-exchange; institutional investors should seek specialized advice.

Evolving tax environment

Thailand has been tightening and modernizing its tax framework, including adopting a 15% global minimum corporate tax for large multinationals from 2025 in line with OECD rules, which may indirectly impact some cross-border investment structures. Foreign investors who become Thai tax residents (e.g., long-term expats) also face evolving rules around taxation of foreign-sourced income remitted to Thailand, making bespoke advice essential.

Foreign investors should always:

- Confirm current interpretations with Thai tax professionals.

- Coordinate Thai tax outcomes with home-country rules to avoid double taxation and ensure correct DTA application.

Major Thai Stock Market Sectors & Companies

SET organizes listed companies into industry groups and sectors that broadly mirror the Thai economy. Key industry groups and representative Thai equities include:

- Resources (Energy & Utilities):

- Financials (BANK, FIN, INSUR):

- Services (Tourism, Transport, Retail, Healthcare):

- Includes Tourism & Leisure (TOURISM), Transportation & Logistics (TRANS), Commerce (COMM), and Health Care Services (HELTH).

- Airports of Thailand (AOT) is a key transport/tourism play in the SET50 index; large retailers and hospital groups are also in SET50/SET100 and central to domestic consumption and medical tourism themes.

- Property & Construction (PROPCON):

- Technology & Communication (TECH, ICT):

- Agro & Food Industry, Consumer Products:

- Capture agriculture, food & beverage, and consumer-related manufacturing sectors that link to Thailand’s role in global food and consumer supply chains.

Recent analyst outlooks for 2026 highlight retail, food & beverage, banking, tourism, healthcare, technology, and communication sectors as favored, while suggesting underweight stances on energy and petrochemicals amid shifting macro conditions.

(Visual to include: sector composition pie chart showing approximate weight of each major SET industry group, with example company names per slice.)

Risks of Investing in the Thai Stock Market

Investing in Thai stocks involves the full range of emerging market risks plus structure-specific issues.

- Market and liquidity risk:

- Although SET is one of ASEAN’s larger exchanges, it is still much smaller and less liquid than US or major developed markets.

- Mid- and small-cap Thai equities can exhibit significant bid–ask spreads and limited daily turnover.

- Currency risk (THB):

- Foreign investors are exposed to Thai baht fluctuations; equity returns in THB may not translate into gains in home-currency terms and vice versa.

- FX volatility often correlates with political and macro shocks in Thailand and broader emerging markets.

- Political and regulatory risk:

- Thailand has experienced episodes of political instability, which can affect investor sentiment, valuations, and policy direction.

- Regulatory changes to foreign ownership limits, NVDR rules, tax laws, and capital controls can alter risk–reward for foreign investors.

- Governance and transparency:

- While many blue-chip Thai listed companies adhere to high governance standards, corporate governance in mid- and small-caps can be uneven.

- Controlling shareholder dynamics and related-party transactions warrant careful analysis.

- Foreign ownership limits and foreign room risk:

- Foreign caps (around 49% in most sectors and 25% in banking) can result in F-share premiums and foreign room closures in popular stocks.

- NVDRs mitigate this but remove voting rights; misunderstanding the distinction between F-shares and NVDRs is a structural risk for uninformed foreign investors.

- Relative performance vs regional peers:

- Recent years have seen Thai equities underperform some ASEAN peers, with investors rotating toward markets like Vietnam and Indonesia that have shown stronger index gains and earnings growth.

Understanding these risks is essential when deciding how large a thai stock allocation to hold in a global portfolio.

Pros & Cons of Investing in Thai Stocks

Advantages and disadvantages

| Aspect | Pros | Cons / Challenges |

|---|---|---|

| Market position | One of the larger, more established ASEAN exchanges; diversified sectors. | Smaller and less liquid than major developed markets; underperformance vs regional peers recently. |

| Access for foreigners | Multiple routes (F-shares, NVDRs, ETFs) and no blanket bans on foreign participation. | Complex foreign ownership limits; need to understand foreign room, NVDR, and share classes. |

| Sector exposure | Strong themes in tourism, healthcare, retail, and regional logistics; high-dividend names. | Sector concentration in energy and financials; cyclical sensitivity to tourism and exports. |

| Taxation | Capital gains on listed shares generally tax-exempt for foreign individuals; predictable WHT on dividends. | 10% dividend WHT and possible 15% tax in some non-DTA cases; need DTA navigation and home-country reporting. |

| Instruments | NVDRs allow economic exposure without foreign cap constraints; active ETF and REIT segments. | NVDRs lack voting rights; some instruments have lower liquidity, especially outside SET50. |

| Regulation & infra | Centralized clearing, T+2 settlement, modern electronic trading with volatility controls. | Regulatory changes (tax, foreign rules) can be abrupt and impact foreign investors’ strategies. |

How the Thai Stock Market Compares Globally

Versus the US

- Scale and liquidity:

- SET’s market cap (≈US$500B) is a fraction of US markets, and Thai liquidity, depth, and derivatives coverage are correspondingly smaller.

- Sector structure:

- US markets are tech-dominated and innovation-heavy, while Thai equities are more weighted to financials, energy, tourism, and domestic consumption.

For global investors, Thai stocks are usually a small “satellite” allocation within broader emerging market or Asia ex-Japan strategies.

Versus Singapore and Hong Kong

- Singapore (SGX):

- SGX functions as a regional listing hub with many foreign companies and REITs; its market cap slightly exceeds Thailand’s in recent data.

- Singapore’s regulatory framework and currency are perceived as very stable, making it favored for regional corporate listings and income strategies.

- Hong Kong (HKEX):

- Serves primarily as a gateway to Chinese equities and is significantly larger than SET in market cap and turnover.

Thailand offers a more “pure-play” on the Thai domestic economy, while Singapore and Hong Kong provide broader regional and international exposure.

Versus regional peers: Vietnam and Indonesia

- Indonesia:

- Indonesia’s exchange (IDX) is now ASEAN’s largest by market cap, driven by commodities and domestic growth.

- Thai stocks, by contrast, offer a different mix of tourism, services, and manufacturing, with arguably more mature governance in many blue chips.

- Vietnam:

- Vietnam has been described as an “ASEAN powerhouse” with strong GDP growth and a stock market rally that has recently outpaced peers.

- Vietnam offers higher growth potential but with frontier-market frictions (foreign room, settlement, corporate governance), while Thailand is more established but lower-growth.

Regional relative value and macro outlooks often drive allocations between Thailand and these peers.

Practical Strategy: Building a Thai Equity Portfolio

For foreign investors treating Thailand as part of a diversified global portfolio, a structured approach is helpful.

1. Define role of Thailand in the overall portfolio

- Consider Thai exposure as part of emerging market or Asia ex-Japan allocations, generally at low single-digit percentage weights for diversified global portfolios.

- Decide whether the objective is:

- Income (dividend-focused Thai blue chips and REITs).

- Growth (tourism, healthcare, tech, domestic consumption).

- Tactical macro exposure (e.g., tourism rebounds, FX views).

2. Choose access vehicle(s)

- Core exposure:

- Use a Thailand or ASEAN ETF if available via your home exchange, capturing SET, SET50, or broader Thai indices; this simplifies handling of NVDR and foreign room.

- Satellite positions:

- For more advanced investors, add select Thai stocks via NVDRs or F-shares, focusing on high-liquidity SET50/SET100 names in favored sectors such as retail, banking, tourism, and healthcare.

3. Sector and factor balance

- Avoid concentration solely in energy and financials; incorporate services (tourism, commerce), healthcare, and selective tech/ICT to better represent the modern Thai economy.

- Consider factor tilts:

- High-dividend banks, utilities, and REITs.

- Quality growth stories in healthcare, tourism, and consumer sectors.

4. Manage FX and tax

- Decide whether to accept THB exposure or hedge it through FX forwards or multi-currency portfolios (where available).

- Factor the 10% dividend withholding tax into yield expectations and check if your DTA allows a credit or reduced rate.

- For frequent traders, verify how home-country tax rules treat foreign capital gains and whether Thai exemptions change your effective tax rate.

5. Governance, liquidity, and execution

- Emphasize names with:

- Strong governance, transparent reporting, and index inclusion (SET50/SET100).

- Adequate daily turnover and narrow spreads to minimize execution costs.

- Use limit orders given the tick size structure and potential volatility, especially in less liquid thai stock names.

6. Time horizon and rebalancing

- Given emerging market volatility, a multi-year horizon is generally more appropriate for Thai equities than short-term trading, except for sophisticated strategies.

- Rebalance periodically to maintain Thailand’s target weight relative to other emerging markets, accounting for regional performance differentials.

Frequently Asked Questions

Can tourists invest in Thai stocks?

In principle, non-Thai tourists can invest in Thai stocks if they successfully open a Thai brokerage or use an international broker that provides Thai market access; there is no rule that limits the stock market to residents only. In practice, opening an onshore Thai brokerage account as a short-term tourist can be difficult because many brokers expect more stable residency documentation and a Thai bank account. For short-term visitors, investing via offshore brokers and Thai ETFs is usually more practical.

What is the difference between NVDR and shares for foreign investors?

- NVDRs give full economic exposure (dividends, rights, capital gains) to the underlying Thai stock but no voting rights, and do not count toward foreign ownership caps.

- F-shares give both economic rights and voting rights, but are constrained by foreign ownership limits and may trade at a premium when foreign room is tight.

For most foreign investors prioritizing returns over corporate control, NVDRs are the default instrument; for those needing governance influence, F-shares are necessary.

What is the minimum investment in Thai stocks?

The minimum on-exchange position is typically one board lot of 100 shares, so the minimum ticket is 100 × share price plus commissions and fees. For example, a 50 THB stock would require about 5,000 THB (excluding commissions), while cheaper thai stock names trade with smaller absolute lot sizes; ETFs and some DRs have similar lot structures but may have lower per-share prices.

What are the “best” Thai stocks to buy?

There is no universal “best” list; suitability depends on risk tolerance, strategy, and sector views. However, many investors start with blue-chip SET50 constituents in sectors like banking, retail, airports/tourism, healthcare, and telecoms because of their liquidity, index inclusion, and analyst coverage. Sector preferences change over time; for 2026, local analyst consensus has favored retail, food & beverage, banking, tourism, healthcare, technology, and communication while being more cautious on energy and petrochemicals. Conduct fundamental and valuation analysis and align selections with a broader portfolio strategy.

How can I invest in Thai equities from abroad without opening a Thai brokerage?

You can:

- Use an existing global broker that offers direct SET trading or access to Thai DRs.

- Buy Thailand or ASEAN ETFs listed on your local exchange that track SET, SET50, or regional indices with significant Thai weight.

- For institutional mandates, work with a global custodian and Thai sub-custodian to access F-shares and NVDRs while managing foreign room and post-trade operations.

This approach simplifies account opening, custody, and tax documentation while still providing thai stock market exposure.